As you, my dear readers know, I often write about really complex, boring, esoteric things that nobody knows anything about, fewer care about, even fewer believe could ever become a problem, and the fewest of the few have the fortitude, understanding or access to the necessary resources, to determine whether the aforementioned “esoteric thing” could jump up, bite the world in the ass, and destroy our beloved Western democracy and civilization as we know it.

That said, DTCC’s (Depository Trust & Clearing Corporation) annual report was just issued a few days ago. The report is a goldmine of wonderful, nearly unintelligible information describing exactly how the plumbing of the global financial system really works.

As always, out of respect for your time, and just in case you aren’t captivated by my long-winded, highly entertaining, comedic style, the important concepts are highlighted in Red embedded in the bowels of this epic work….

I had first written about DTCC in 2016. (Link below) Scroll down the the Section “Who is FICC?”:

And most recently in January of 2020 in my “Novella” (link below). Scroll down to “DTCC & FICC – Potential “Choke Point”:

The Stealth Nationalization of America’s Banks….an “Economic-Whodunit-Thriller-Novella”

Here are the links (below) to the DTCC 2019 Annual Report and Audited Financial Statements for your amusement:

https://www.dtcc.com/annuals/2019/

https://www.dtcc.com/annuals/2019/pdf/DTCC-2019-Annual-Financial-Statements.pdf

I’d invite you to revisit my previous commentary if you have time, but I’d also suggest that it’s not mandatory to understand the gist of where I’m going with today’s tome. If, however you choose not to revisit my prior work, and you have no idea what DTCC is/does, here’s a quick summary from my January piece:

My perspective is that this little tiny, privately controlled, industry-owned service provider, which handled and cleared roughly $2.2 Quadrillion in notional value (more than $8 Trillion per banking day) of securities/loans in 2019, is a bit like an Online Trading Platform (i.e. like your on-line account at E-trade, Fidelity or Schwab, etc.) for MIT & Ivy League trained quant-money managers running algos. There are roughly 1,000 “Sponsoring Members” (Primarily Banks) who control access to the system and vet “Sponsored Members” who would be authorized to access the system/markets/platforms with the permission and authorization of the “Sponsoring Member“. Think of it as you (Sponsoring Member) giving your cousin (Sponsored Member who you know pretty well and trust) account access and your password to make trades. He/she makes the decisions but you, the Sponsoring Member, are on the hook if he/she screws up.

Of course, these digitized securities never actually go anywhere. They don’t move. They sit in a depository somewhere, perhaps one of the Four Horesmen, while DTCC/FICC processes the ownership change transactions and authorizes/remits netted funds based on the trades back to the buyers and sellers at light speed.

As an aside, I have to wonder, philosophically, why the global financial system actually needs quadrillions of US Dollars, rehypothecated repository collateral and the associated commitments to close/pay flying around the globe at light speed, between self regulated banks, fund managers and counter-parties “loaning” their reputation and credit worthiness out to international, ShellCo Hedge Fund customers and investors where recourse rights, recovery and resolution in the event of a default might be complex, if not impossible to define or enforce. Perhaps it’s just me. I’m sure everything is just fine and dandy.

Here are a few of the highlights from the current, 2019 DTCC Annual Report:

In my January discussion I had forecast that the USD value of transactions cleared by DTCC in 2019 would be $2.2 Quadrillion dollars. I was way off (sorry). Actual cleared transactions came in at a paltry $2.15 Quadrillion. I was off by $85 Trillion, roughly 4x US GDP. Oddly enough, this is the first time in my long, illustrious career that one of my projections has been off by a nominal value of that magnitude, while still being less than a 4% error from the actual.

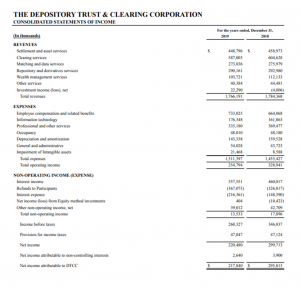

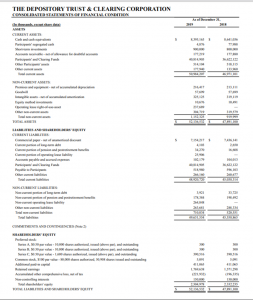

The financial statements showed a reduction in both Revenue (-1%) and net income (-26%), as well as what one would think might be a relatively insufficient $4.2 Billion increase (11%) in Customer Clearing Funds (margin deposits), when compared to a $300 Trillion increase in transactions processed, i.e… Customer Clearing Funds increased a minuscule 0.001% of transaction volume even though transactions increased by 70% from 389 million ($4.76 million per transaction) in 2018 to 654 million ($3.29 million per transaction) in 2019. Put another way, margin deposits barely increased while revenue and income both declined, in the face of significant increases in both the number and aggregate dollar value of cleared transactions. This odd financial performance is likely reflecting the “Go-Go Risk-On-Oprah-esque-Everybody-Gets-A-Car” mindset which was pervasive in the financial markets just a few short months ago, opening up the US Financial Markets to just about any financial entity with a legal team and a pulse. Here are the Balance Sheet and Income Statement for your review:

Again, for emphasis, both Revenue (fees) decreased 1% to $1.766 Billion and net income was down 26% to $216 million while transaction volume was up by an incredible 16% ($300 Trillion) to $2.15 Quadrillion, apparently reflecting an ever growing desire to lure even more questionable counter-party risk into the pool and “do even more for/with less”. If I wanted to open up the spigots to all sorts of entities who’ve never had the privilege of access to the US Financial Markets before, I would reduce counter-party underwriting, slash prices and decrease margin requirements. It looks exactly like what they were doing.

Moreover, we also notice that the Annual Report completely omitted any data or discussion regarding foreign office openings, head count increases or any metric relating to off shore transaction volume, which they had described as their greatest growth area and source of new business over the last decade in the 2018 Annual Report. Every year they had described, with apparent great pride, their success in opening 13 new offshore (non-US) offices (compared to 3 new US Offices) and hiring nearly 2,000 new employees since the 2008…..a strange omission and an odd “about face” to say the least. Here’s what the 2018 Annual Report described in both 2008 and 2018….

Again, in the 2019 Annual Report, there is absolutely no discussion of foreign offices, employees, transaction volume or any other related metrics that were paraded as the “crown jewels” of this business just last year. Perhaps management sensed a growing level of discontent with financial globalization and chose to remain silent? Perhaps it’s a stealthy acknowledgement of potential operational issues and potential risk …by omission? Below is the only statement in the report that comes close to disclosing anything about the growth areas in this business (and the potential ticking time bomb, Sponsored Repo, I had described in my January analysis).

The above illustrates how the demand for this product has skyrocketed. The “Sponsored Repo“, only a few years old, is still in its infancy, yet we’ve seen a record one-day “Half Trillion dollar” settlement in December of 2019 only a few months ago….as you recall, December of 2019 was a relatively stable, serene “day at the beach” when compared to what’s been happening in the Repo markets over the last month. Since DTCC has chosen not to disclose any of the information that was formerly described, with great pride, in every annual report since the GFC we can only assume that these markets, products and foreign entities, by virtue of their enormous transaction volume, might just be ground zero for at least some of the manufactured “dollar shortage/hoarding”, stress and turmoil that our financial markets are currently experiencing.

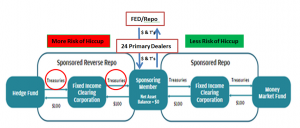

I had included the graphic below in my January “Economic-Thriller-Whodunit-Novella” describing the mechanics and associated risk in moving FED Repo money through the 12 sponsors to the the 1,800 Sponsored Members.

In that “Novella” I also discuss how, because the “Sponsors” have no restrictions on the collateral they accept (i.e. the collateral may or may not be Treasuries….likely “not”, and the probability of a hiccup when closing out these Repos increases dramatically under stress), that there is a good chance that increased systemic risk (the left side of the diagram) has been exchanged for a couple of basis points of profitability. There’s a reason that the FED suddenly announced $500 Billion rolling, Overnight and Term facilities, and I’d suggest, just as during the Great Financial Crisis and the Lehman wind-down, DTCC is likely right smack-dab in the middle of it.

If there’s a positive aspect to any of this, we are indeed fortunate that the folks at DTCC were able to hone their talents, developing a practical experience skill-set with this type of systemic-risk and the resulting wind-down during the last GFC. I’d invite you to review their description of how they saved the world from their own negligence as they wound down Lehman Brothers positions during the GFC. Here’s the link to the full Annual Report:

Download the 2008 DTCC Annual Report (PDF)

Download the 2008 DTCC Annual Report (PDF)

I’ve listed a few of my favorite comments in the report below to give you a feel for what the the folks at DTCC were dealing with at the time (the discussion begins on page 14 of the Report):

Sunday, September 7

“Federal government puts Fannie Mae and Freddie Mac into conservatorship. Rumors begin about other firms that may be in trouble, including Lehman Brothers Holding, Inc. (LBHI), the holding company that had a brokerage subsidiary, Lehman Brothers, Inc., which was a major member of various DTCC subsidiaries. It ranked as a top-three user of DTCC’s mortgage-backed securities division. It was a top-five user in DTCC’s U.S. government securities division and at Deriv/SERV for OTC derivatives. And it was in the top 10 of users at the National Securities Clearing Corporation (NSCC), and at The Depository Trust Company (DTC).”

Tuesday, September 9

“Lehman Brothers, Inc. placed on highest level of surveillance by DTCC. Additional Lehman clearing funds are demanded by NSCC and FICC. ”

Sunday, September 14

Talks for takeover of Lehman break down on Sunday. DTCC

is advised Sunday evening that LBHI will file for bankruptcy. (Authors Note: the time between DTCC hearing the “rumors” and the bankruptcy filing was one week….they were clearly all over this from the very beginning)

“Nightmare’ Scenario…For DTCC and its subsidiaries, a nightmare was all too possible. After all, as central counterparties, they had guaranteed completion of billions of dollars worth of Lehman’s trades. If they incurred substantial losses when winding trades down, they would need to start drawing on clearing funds their customer-members maintain with them in case of defaults. Never in its 35-year history had DTCC been forced to do this.”

“The lights burned through the night in an all-hands-on-deck

exercise as more and more numbers were entered into spreadsheets. And by the next day, some $300 billion in Lehman forward mortgagebacked securities trades – or about 90% of the value outstanding – were netted out. The securities industry heaved a collective sigh of relief. Yet Lehman’s book held close to $200 billion in other trades as well – all of them guaranteed by DTCC companies.”

Keep in mind that the remarkable wind-down described in the 2008 DTCC Annual Report related to just one defaulting entity. We can assume, with relative confidence, based on recent events and unprecedented, behind closed doors, FED and Central Bank Response, that there is something rotten in Denmark (or more likely, the rot is originating in the Caymans, Luxembourg, Hong Kong, Singapore and many of the anonoymous-offshore-money-laundering-tax-havens)

You’d also think that even though DTCC’s Annual Report was produced for the calendar year ending 2019, as it was produced and posted to the website just a few days ago, on April 8th 2020, that there would at least be some sort of “Subsequent Events” disclosure in the report covering things like: “The outlook for our business and financial hurdles to overcome during the greatest global financial collapse since the Great Depression” as required by GAAP….and you’d be right. Deloitte & Touche LLP accepted management’s disclosure and certified the language in their unqualified audit opinion (Page 1). The “Subsequent Event” disclosure paragraph is listed prominently, on the very last page (pg 51) in one, big, bold (fine print…elephant in the room) paragraph:

24. SUBSEQUENT EVENTS

The Company evaluated events and transactions occurring after December 31, 2019 through March 27, 2020, the date these consolidated financial statements are available to be issued, for potential recognition or disclosure. No additional events or transactions other than the ones mentioned below occurred during such period that would require recognition or disclosure in these consolidated financial statements.

………..

The recent outbreak of the novel coronavirus (“Covid-19”) in many countries continues to adversely impact global commercial activity and has contributed to significant volatility in financial markets. The World Health Organization has declared COVID-19 a “Public Health Emergency of International Concern.” The global impact of the outbreak has been

rapidly evolving, and as cases of the virus have continued to be identified, many countries have reacted by instituting quarantines and restrictions on travel. Such actions are creating disruption in global supply chains, and adversely impacting a number of industries. The outbreak could have a continued adverse impact on economic and market conditions and trigger a period of global economic slowdown. The rapid development and fluidity of this situation precludes any prediction as to the ultimate adverse impact of Covid-19. Nevertheless, Covid-19 could have a material impact on the Company’s financial condition. In addition to the factors described above, other factors either in the U.S or internationally that may affect market, economic and geopolitical conditions, and thereby adversely affect the Company’s business include, without limitation, economic slowdown, changes in interest rates and/or a lack of availability of credit, changes in law and/or regulation, and uncertainty regarding government and regulatory policy.

The above language, (highlighted in Red Underline for emphasis) roughly translated means, generally…..”We have no idea what’s happening to our business….and even if we did we certainly have no reason or legal requirement to disclose it here…. but we think everything will be Ok.”

Since DTCC only produces Annual Reports, even though they are an “industry self-regulated” integral part of the global financial plumbing…. and clogged pipes, overflowing financial toilets and illiquid debt-filled bathtubs tend to wreak havoc on all of us, we won’t know what actually happened until they issue the 2020 Annual Report, to be issued in April of 2021. I’m sure their Lehman-esque discussion of “how they somehow managed to save themselves from themselves” will be impressive.

That said, if there were liquidity/settlement problems at DTCC right now, like anyone following this might suspect, it would have been a bit easier on the financial community if DTCC management would have just stepped back, taken a deep breath, and took the time to describe exactly what’s going on, in this “Subsequent Events” Section of the report, rather than remain silent/vague while presumably conducting closed door meetings with regulators, and Central Banks attempting to fix the mess behind the curtain as they had done with the Lehman collapse.

Finally, not to be too harsh, what type of risk manager, on any planet, would manage the capital and leverage structure of any business which could cause it to close down, sacrificing decades of work and effort, and in this particular case, the normal functioning of the global financial markets, almost immediately, in the event of a completely predictable systemic event? Why do I say it was predictable? Because they just went through it twelve short years ago.

In any case, of course, we all hope that DTCC is doing just fine and that I’m dead wrong. On the other hand, based on everything that’s transpired since they’ve closed the books on 2019, I doubt that things are “just fine”.

Here’s why….

Section 4003 of the Cares Act HR-748 (pg 512)

The CARES Act, the most Kleptocratic legislation in the history, included a provision (Sec 4003) which generally provides for the greatest, unilateral monetary expansion and consolidation of political power in history. Section 4003 generally gave authorization for Steve, as the Treasury Secretary, to establish facilities (Special Purpose Vehicles – SPVs), working hand in hand with the FED, which will be responsible for deploying up to $500 Billion in “taxpayer relief money” to save American “businesses” (i.e. buy failing assets) which need help, as broadly described in the Act. Now that the “voice vote” is complete in the House, we see how this bill came to pass. The link to my recent commentary on the CARES Act is immediately below. Feel free to peruse my commentary if you need a quick diversion….

The CARES Act….The Beginning of the End of Western Democracy….

The Democrats have negotiated roughly $240 Billion of “Miscellaneous” (Page 609 thru page 880) pay-to-play “pork” to be distributed to their own constituents and special interests, in exchange for allowing the Republicans to funnel dump-trucks full of freshly printed US Dollars to Steve’s friends, in order to get this horrific bill passed. Our lawmakers and political parties, as odd as it might seem, are all on the same team now. They are all working together in a coordinated feeding frenzy, diligently shoveling as much money, as quickly as possible, to their respective constituents, causes and favorite sons/daughters in an incredible effort to retain their offices and buy votes. They are are following Oprah’s lead now….”Everybody Get’s a Car!” Our lawmakers are shouting to the electorate “Look what I’ve done for you! (or should we say “to you”)….YOU HAVE TO KEEP ME IN OFFICE!”

Now that the mechanics of these facilities have been officially announced, we can take a deeper dive into what these wonderful facilities and vehicles actually are and do.

Here’s the FED Press Release describing the first five facilities (with more to follow).

https://www.federalreserve.gov/newsevents/pressreleases/monetary20200409a.htm

The five (5) facilities are as follows:

- PPLF “Paycheck Protection Loan Facility” which will hold SBA loans made under the “Paycheck Protection Program” (much of this collateral to be “forgiven”) provided by the Treasury.

- PMCCF “Primary Market Corporate Credit Facility” which will hold Corporate debt/bonds directly, and the:

- SMCCF “Secondary Market Corporate Credit Facility” which will hold securitized bonds/debt/ETFs, and the:

- TALF “Term Asset-Backed Loan Funding” which will hold pools of Assets like 1) Auto loans and leases; 2) Student loans; 3) Credit card receivables (both consumer and corporate); 4) Equipment loans and leases; 5) Floorplan loans; 6) Insurance premium finance loans;

7) Certain SBA Loans; 8) Leveraged loans; or 9) Commercial mortgages, and the: - MLF “Municipal Loan Facility” which will hold troubled Muni-Bonds

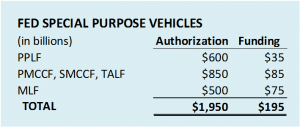

The total of these facilities will be authorized to purchase up to $1.95 Trillion of America’s distressed assets “on Margin” while only “spending” $195 Billion of “Taxpayer Money”. The remainder of the funding will be “printed”. Here’s the breakdown for the facilities:

So in effect, to draw a parallel, through these five Special Purpose Vehicles the FED is likely buying the baddest of bad assets on “margin”. They are buying $1.95 Trillion in Asset Value, putting $195 Billion (10%) “down” using “taxpayer money” from the Treasury . The difference ($1.755T) between the Treasury Funding and the Purchase price ($1.95T – $195B = $1.755T) will be “printed”. These “securities” and their valuations will be locked in amber on the FED Balance Sheet forever.

Based on the structure of these SPV’s it wouldn’t be far fetched to believe that the big banks might be scouring their books for illiquid “junk” that fits the profile of what the FED will be buying. They will package it all up, tie a bright red bow on it and sell it to taxpayers (via the FED) at some contrived, bloated price. Moreover, once the bank customers (perhaps DTCC members/clients) figure out what the FED is buying, perhaps with the consultation and advice of their particular bankers, the DTCC customers might also begin selling some of their illiquid “junk” to their banker in order to get a piece of the bail-out. Trump Bucks and Mnuchin Money all around!

Moreover, it’s likely that these five, just announced Special Purpose Vehicles, because of the leverage available (10:1 Assets/Appropriation) are only the first salvo fired from a Gatling gun of Monetary expansion. At 10:1 leverage, every $1 Trillion of “Taxpayer Equity” can support $10 Trillion of “bad assets” using $9 Trillion of “printed” money. We’re already hearing rumblings from Democrats in Congress that they “need more for the Main Street Economy”, so if the tit for tat formula holds, $1 of Republican Kleptocratic Appropriation for each dollar of Democratic Socialist Appropriation, with 10:1 money “printing” applied to the Kleptocratic side of the asset purchases, we can expect the FED Balance Sheet, the money supply and the National Debt to skyrocket. I had forecast in my “Novella” that we were looking at a FED Balance Sheet of $25 Trillion by the end of 2024. Based on what we’ve seen in the last month, we are well on our way.

The FED Balance Sheet has increased roughly $2 Trillion in the last month. To put this in perspective, as a point of reference, this increase is the equivalent of the entire US Government Budget in 2003 (nominal value). That, my friends, wasn’t all that long ago.

As our legislators, the FED and indeed the world’s Central Bankers, continue on this unfortunate monetary trajectory, we continue to wantonly starve, destroy and socialize our Main Street Economy, ripping the competitive spirit out of what was once the greatest industrial and technology juggernaut the world has ever known, simultaneously printing and siphoning off dollars for the world to reinvest in puffed up US Dollar denominated Assets of dubious intrinsic value. The world will continue to rely on America’s “rule of law”, financial guarantees and relative safety as more and more of America’s precious dollars are pumped into the global financial system, to be reinvested (by foreign entities) in America’s financial assets. America will be producing less and less while the standard of living in fly-over America continues to slide, and nominal “investment” in American Assets by foreign entities continues to grow. Our leadership and bankers will continue the cycle, printing ever more money, supporting these asset values, eliminating price discovery and eventually locking-in these Asset values forever on Central Bank Balance Sheets. Our Bankers will gleefully ride atop their financial devices, Special Purpose Vehicles and Repo facilities, flailing their arms in excitement, celebrating their successes, in the technocratic belief that have been saving the world from crisis after crisis, when in reality they will have been accelerating toward ground-zero in the greatest conflagratory financial detonation the world has ever known.

Remember, what doesn’t kill you only makes you stronger…..or at least that’s what everyone tells you when you (not they) are going through really difficult times…..

Of course, the unspoken corollary to that is:

“Sometimes it just kills you….”

What We Should Have Done…..

Simpy put, we should be taking every step possible to support the “real economy” and eliminate the quixotic effort to support absurd asset values. Asset values resulting solely from monetary expansion simply aren’t viable unless there is a ground-up, broad-based, robust, “real economy” supporting the valuations. This is what makes the CARES Act such a dangerous, diabolical gateway document. It sets the stage for unfettered monetary expansion, without regard to real economic growth. Here’s the thumbnail sketch of what should have been done:

1.) As described above Steve & Don’s Friends and Family Sec 4003 Bailout Bonanza, creating a potential $5 Trillion slush fund ($500 Billion funding at 10:1 leverage to be run by the FED) to rescue and collect “bad assets”, exchanging them for cash, should never have been created. I can imagine Softbank selling WeWork debt to a hedge fund, the hedge fund selling it to a Big Bank and the FED buying it effectively “selling it to taxpayers”….as a friend of mine often says “such a deal!”.

The Treasury should have established the $500 Billion fund (perhaps much more) as a “Big Business” paycheck protection SPV in support of struggling larger businesses, but using the Reorganization Provisions and Creditor Protections already available and in place under the US Bankruptcy Law. Every Businesses (remember the old “Railroad Reorgs” that took 30 years to complete?) would continue to operate under protection, employees would be paid, vendors would receive guarantees, equity and debt would be refinanced or wiped out, creditors would be paid according to individually negotiated/determined parameters and the businesses would emerge if deemed to be financially viable, with the courts making full use of Treasury Funding and guarantees. In short, the states, courts and appropriate jurisdictions, NOT the FED/Treasury should have the sole ability and discretion to determine who lives and who dies.

2.) SEC. 4022. FORECLOSURE MORATORIUM AND CONSUMER RIGHT TO REQUEST FORBEARANCE. (Pg567) should have been expanded dramatically. The greatest fear American’s have right now is being tossed out of their homes. Because of the program limitations, it applies only to roughly 20% of the residential real estate in America. In short, 80% of US Homeowners and renters are a couple of missed paychecks away from getting a foreclosure/eviction notice. We absolutely can NOT allow this to happen, throwing people out on the street, letting homes go vacant, again. The obvious solution would be require, upon request of the borrower, whether it be the homeowner or the landlord to defer up to 1 year of mortgage payments (12/360ths on a 30 year note) to a term end balloon payment and a 2 month (2/360ths on a 30 year note) “debt jubilee” on ANY RESIDENTIAL 1-4 FAMILY PROPERTY. (need testing restrictions would apply). The primary economic impact of this policy would be to free up cash (and remove fear) for working Americans giving them a chance to hang onto their homes, in exchange for a presumed relatively minor reduction in the value of the Mortgage Backed securities these loans are tied to.

3.) SEC. 2102. PANDEMIC UNEMPLOYMENT ASSISTANCE state funding should have been increased to “not to exceed 52 weeks” rather than 39 weeks….as the Act currently states (page 90). The silly “Trump Bucks” $1,200 checks, should have been eliminated to fund this expansion. It would have been more than enough, with funding left over to go to food pantries.

4.) The PPPL – SEC. 1102. PAYCHECK PROTECTION PROGRAM (page 9) should have been Expanded (as of the date of this writing demand has already surpassed funding), to at least 6 months, rather than the 2.5 months using only a portion of the equivalent of the Sec. 4003, $5 Trillion, (10:1 leverage) Don & Steve’s Friends and Family, Excellent Adventure slush fund. The Paycheck Protection Plan should have been at least doubled, again funded by the Treasury but managed by the states who have boots on the ground. Fly over America is on the verge of losing its small business engine.

5.) TITLE III—SUPPORTING AMERICA’S HEALTH CARE SYSTEM IN THE FIGHT AGAINST THE CORONAVIRUS (297 pages) should have been analyzed more in the context of an emergency, than what we see in the bill. To be honest, I just don’t have the aptitude or training to analyze and/or discuss the merits of any part of this section. But, here are just a few of the confusing titles/sections that make me wonder exactly why these Appropriations are in an “Emergency Bill”:

6.) Most of the Misc Provisions – Page 609 thru Page 880 – 271 Pages…..$239 Billion Dollars should have been stricken from this bill. For those of you who are familiar with how legislation is drafted, the “Miscellaneous” section is usually where lawmakers hide all the “pork”. Pork is simply a cute, colloquialism for “buying votes”. It’s akin to taking taxpayer money from people in one part of the country and making them pay for something, that may or may not be needed, wanted or necessary, in another part of the country, in order to get a law passed and hopefully, for the sponsor, effectively buy some votes in his/her district. This is how we get “bridges to nowhere”, “Big Digs” libraries, freeways, airport terminals, etc. etc. named after Congressmen and Senators. Simply put, if you are a legislator sitting on the fence in a close vote, if you play your cards right, you might get funding for a pet project, to be named after you, in your district, if you do indeed see the merit of the other pork-filled provisions of the bill and “get on board” to get it passed.

That said, there were 144 separate, “Miscellaneous”, “emergency” funding provisions of HR-748 which total up to be $239,090,725,008.00. Again, I don’t have the background to determine if these expenditures are what the American people really want or need. I don’t understand the genesis of these appropriations, nor what the motivation is in including them in an “emergency” Bill like this. Again, I’m not questioning the value/importance of these ADDITIONAL Appropriations. I’m questioning their inclusion in an “emergency” bill like this.

For example, If I were a legislator, getting ready to cast my voice vote that nobody cares about, I couldn’t make any effective judgement or conclusion, because of the lack of specifics, on the merit of the individual Appropriations classified as an “Emergency Appropriation” for example:

Again, the above “pork” was thrown in and buried at the very end of the document in hope that nobody would read it, or attempt to track down the sponsors to find out why the Kennedy Center, the African Development Bank, Howard University and the National Endowments for the Arts and Humanities actually needed “Emergency Corona Virus Funding”.

7.) Immediately increase the $250,000 FDIC deposit guarantee to $1,000,000 and provide immediate, overnight funding facilities to smaller Banks to prevent “runs” and capital flight from smaller, non systemic banks. Larger commercial depositors have been fleeing small/mid-sized banks for years. There are 1/5th the number of Banks in America as there were 20 years ago. The trend will continue unless we level the playing field. I envision American cities and towns with populations less than 50,000 people will soon have their financial needs (or what’s left of them) serviced by ATMs run by the “Four Horsemen” (JPM,BAC,C,WFC). Unless we do something, heartland America is one more business cycle or two away from becoming an economic wasteland.

8.) Regulate DTCC, Affiliates and its Sponsoring Members under both the Federal Reserve Act and the War Powers Act. Strictly enforce international “know your customer laws”, fully documenting sources of funds “down the chain” with significant civil and criminal penalties assessed for perpetrators, accomplices and (especially) their lawyers. Seize the funds of non-conforming entities, rogue foreign government surrogates and money launderers. Oh hell…..on the other hand, let’s just blow it up and get rid of it all together. We need to take our ball and bat and go home.

There You Have it…..

The financial framework for the destruction of the Western financial system has been carefully, meticulously constructed over the last decade. Foreign interests, through our banking system and wonderful businesses like DTCC have made the sport of “dollar hoarding” an international pastime. The only thing standing in the way of the complete and total destruction of the Western financial system was the well balanced gridlock promulgated by the tenacity of the socialist left standing up the the Kleptocratic right….and it’s gone. Now, it’s likely that the Democrats have come to the realization that the Justice Department will be selectively used as a weapon to root out opposition. After all, there’s likely a treasure trove of criminal material, typical of “just doing Congressional business” out there that a couple of well crafted Bill Barr subpoenas could easily unearth on most, especially the “uncooperative”, members of Congress. The Democrats have apparently overplayed their hand with the impeachment effort and have now collectively succumbed to the pressure of the Kleptocracy. With the passage of the CARES Act HR-748, and I’m sure, reams of follow-on legislation, cementing the roll-up of power, making the establishment of the United Kleptocracy of America a near certainty, there is now documented legislative authority, supported by our Supreme Court’s Kleptocratic majority, making all of this perfectly legal under the Constitution (Remember the Constitution?…that was a cute, silly little document in its day, wasn’t it?). The tools of our own demise are now firmly in place, summoning and likely guaranteeing the destruction of the greatest Democratic experiment in the all-time-history-of-all-time-history.

It’s now clear that the world’s elite all seem to have unabashedly lost touch with the unfortunate, unwashed, floundering, directionless rabble, which is frighteningly capable, willing and already expressing themselves with, what some might say, the appropriate level of rancor.

Though their poetic language is often littered with unsavory, unsophisticated, impolite rhetoric, difficult for bankers, politicians and economists to understand….it tends to get the point across quite well….