As the self-proclaimed creator of the Financial Comedy genre, I feel occasionally obligated to continue my quest, taking cutting edge, ground breaking economic and financial research to the “I’m hanging-on-every-word-chart-and-table” level of suspense. Today, I’m again taking a risk, jumping out of the box and presenting to you, for your pleasure, amusement and enlightenment, the first ever, in the history of literature…..an “Economic-Whodunit-Thriller-Novella“. (Wild applause!!….YAYYY!!)

I’d also suggest, to retain your sanity and manage your resting heart rate, that you read this over a few sessions, perhaps enjoy a nice coffee/tea or your favorite beverage, while sitting by a crackling fire, or maybe read it in segments on a long plane flight or on a beach somewhere. This is going to be a really hard read. You should ponder its assumptions and conclusions. Let it all sink in. I’m hopeful you’ll find it to be, at a minimum, a real page turner. Unfortunately, if you believe what I’m writing here today is even directionally accurate and/or could even be remotely possible given the current condition of America’s economy and financial system, you may need something a bit stronger than coffee or tea by the time you reach the bitter end of this novella.

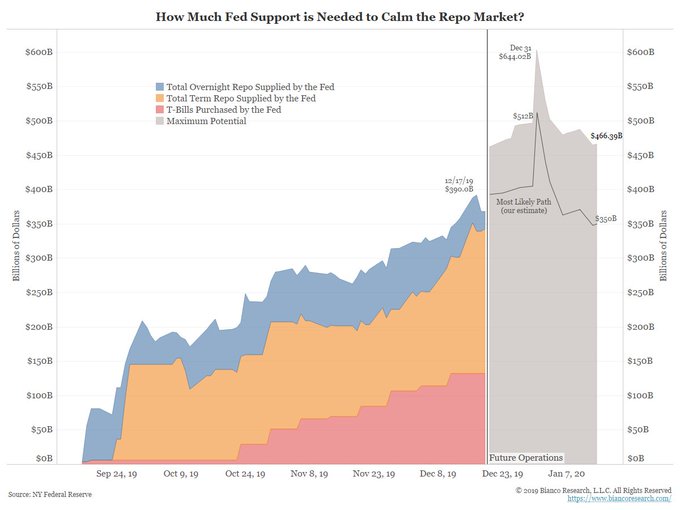

Before we get into the end game of today’s post, let’s take a look at where we are. Jim Bianco @BiancoResearch produces some very nice, compact work. The chart below describes that the US Banking/Financial System, to date, since the middle of September, has surprisingly required roughly $400 Billion more Repo/Liquidity than it did in September. Jim is also forecasting that during the peak of “Window Dressing Season” the US Financial system will need roughly a half-Trillion dollars more than it did just three short months ago.

In any case, let’s continue our efforts to help the FED try to figure out exactly why this is happening, what it means and what to do about it.

All data discussed today is courtesy of Treasury.gov, SEC.gov (10k’s, 10Qs and filed Correspondence), the Bank of International Settlements and some extrapolated/calculated “guesses” on my part. (FYI – America’s Economists, lawyers and bankers generally never “guess” about what might happen….it’s not their job….if they don’t have pristine, accurate data they quit, they collect their paycheck and move on to the next theory as we all wait for the system designed by these folks to drop a piano on us when we least expect it.)

Abstract of Today’s Post

Thesis, to be tested over time:

Given:

- USD Liquidity is leaving the US Banking system at a much greater, accelerating rate than the FED understands or will be able to effectively backstop.

- The FED can add stimulus indefinitely. Unfortunately, they have no control over where it goes.

- The “Four Horsemen of the Apocalypse” (JPM, C, WFC, BAC) have been operating on a “zero cash” basis throughout 2019. We must analyze them as one, quasi-systemic, State-Owned-Enterprise (SOE), operating with impunity, fully supported by FED “Too Big To Fail” policy.

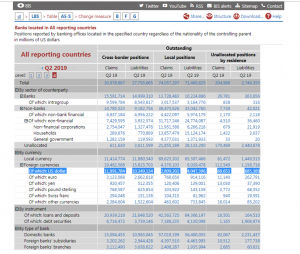

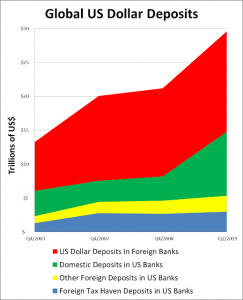

- Per the BIS, US Dollar off-shore deposits (outside the US Banking system) are greater than $15 Trillion now.

- Bank Deposits within the US Banking System controlled by foreign entities are now more than $5 Trillion.

- Of the $30.1 Trillion USD Bank Deposits/Liabilities in existence, currently only $9.6 Trillion (32%) are available to the US Domestic Economy. The remaining 68% are controlled by foreign, anonymous entities/ShellCos/Investors. Based on the current need for emergency cash/stimulus, we must assume foreign demand for off-shore US Dollars is accelerating. The demand for safe haven Us Dollars and Assets has never been greater.

- Off-Balance Sheet Assets (Swaps/Forwards) creation is accelerating as well. Per most recent BIS data USD FOREX Contracts (notional value) have increased 16% to $87 Trillion and US Dollar Interest Rate Contracts (Swaps/Forwards) have increased 28% to $199 Trillion in the last year and a half (data through H1 2019).

- In aggregate, we can estimate that the Chinese Communist Party currently controls more than US$30 Trillion of Western Financial Assets scattered around the globe outside of mainland China. This war chest continues to grow at roughly $40 Billion a month.

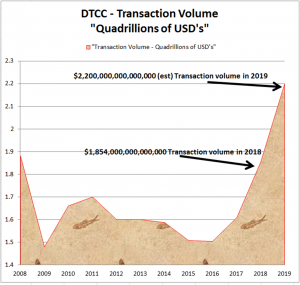

- The “Choke point” DTCC/FICC, a relatively tiny, nondescript, industry-sponsored business, dedicated to supporting bank and hedge fund day trading, is expected to clear $2.2 Quadrillion in transactions in 2019, nearly double what they had done five years ago, prior to making their services available to “sponsored” i.e.) Off-Shore masked Chinese Communist Institutional Day-trading.

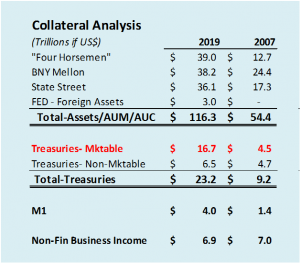

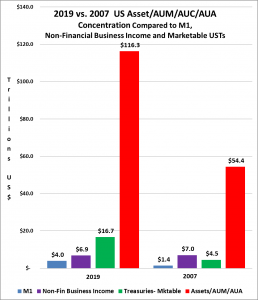

- Financial Assets, Assets Under Management, Custody and Control at the Six Largest Financial Institutions/Custodians (The “Four Horsemen plus Bank of New York Mellon and State Street Corp.), representing concentration of roughly 85% of the equivalent of all US Dollar Assets, have more than doubled to $116.3 Trillion since 2007, prior to the Great Financial Crisis. This CAGR of 6.5% compares to an inflation adjusted decline of 20% for Non-Financial Business Earnings before Interest and Taxes, a surrogate for the “real economy” during the same period. (Even though I’m told there’s “no inflation” that 1.9% discount rate has a real impact over twelve years.) In other words, today it takes more than double the value of Assets to produce significantly less “main street” income than it did 12 short years ago.

- Velocity…today’s monetary policy is the financial equivalent of attempting open hear surgery with a chainsaw. The FED’s toolkit (interest rates and “money printing) is woefully inadequate, and in fact, harmful to the “real economy“. We are creating assets that are destined to be revalued and weaponized against the dollar. The FED must recognize this soon, make some really tough choices and use its regulatory power to prevent dollars from going where they shouldn’t go. I’m sure the FED will do their best, but in the end, if they continue to use this financial chainsaw, rather than a scalpel, the patient won’t stand a chance.

- The more dollars the FED prints, the more they are “pushing on a string”.

- The combined Market Cap of the F-MAGA stocks is $5.22 Trillion or roughly 15.5% of the current valuation of all Us Equities. These high value targets are the equivalent of the Pacific Fleet floating safe and secure on their Pearl Harbor moorings, without air cover, on December 6th, 1941. (Note: The F-MAGA moniker would indicate that the Chinese Government, although it’s trying to destroy us, is not without its sense of humor.)

- The Chinese Communist Party will have recruited (and will continue to recruit) legions of eager Western “helpers” to accomplish this “Pump & Dump”. Politicians, regulators, Investors and the Big Banks will all be clamoring for freer flow of even more capital, less regulation, further opening of direct Fed financing, eagerly dancing to the the CPC’s siren song. Every Investment House, Big Bank, Hedge Fund and Pension Fund worth their salt, will have access to Chinese market intelligence, recruit Chinese management and open offices in Shanghai (if they’ve not done so already) with the only goal being to maximize their returns on these investments. The only way they’ll survive is to truly be in the loop when “Blue Horseshoe Loves Anacott Steel….or Hates Blue Star Airlines”.

- As the Chinese Communist Party continues to siphon off US Dollars, American Financial Market indexes will begin to resemble a downward skewing sine wave, spiraling skyward as the Chinese “pump” and careening South as the Chinese “Dump”.

- I find it particularly ironic that after all of the IP theft, industrial and military espionage, fake financial statements and knock-off retail goods, that the Chinese Communist Party actually copied their master plan to destroy America from a 1987 Charlie Sheen movie. They aren’t even capable of coming up with a single, original idea for America’s eventual demise…..we had to come up with it for them. Who says American ingenuity is on the ropes?

Thesis: The US Dollar has been weaponized, by Chinses and foreign ShellCo interests against America. FED Policy today is the greatest strategic financial mistake in history and will result in the eventual collapse of the US Dollar, Banking System and Western Democracy. We must not continue on this accommodative path. We must immediately develop and deploy targeted, effective capital controls to prevent the Chinese Communist Party from dominating US Dollar denominated markets , destroying the US Financial System and accomplishing the greatest “Pump & Dump” of financial assets and consequently, the greatest “Hail Mary” currency manipulation in history.

The Four Horsemen of the Apocalypse

What if I were running a large Bank and my government came to me and said?:

“Don’t worry, we’ve got your back…no matter what…”

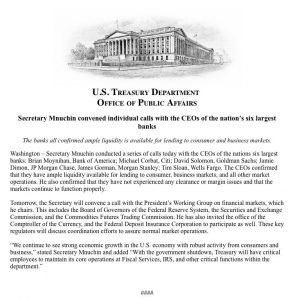

…as Steve Mnuchin did in his infamous Christmas Eve letter of 2018…

If I were a titan of finance, running a large US Bank, after reading that letter, I’d try to make a confirmed judgement on Steve’s ability to deliver on this promise, and after careful analysis, I’d eventually conclude that I did indeed have a blank check to run lean and mean, fearlessly providing capital as I saw fit. I would immediately suggest, indirectly, by tacit approval, that my minions should:

- Forge out into new markets and land new customers, deploying every nickle of every deposit, on any fee generating, securitized, heads-I-win-tails-you-lose project (like buying up non-performing Chinese loans, securitizing them and selling them to Pension Funds, for example) and customer relationship they could come up with, knowing that the FED would be there to immediately provide cash if anything ever went sideways.

- I’d informally ignore cumbersome regulations, feeling more empowered than ever to write nearly any deal, knowing that we have effectively stacked the understaffed regulatory bodies with former insiders who will be increasingly amenable to our cause, shining light on only minor indiscretions, levying teensy-weensy fines where politically necessary, but more often, simply standing down and letting our “free market” bankers do their jobs.

- Scour the planet for previously untapped capital sources and deals overseas, remove any level of transparency and fully open US Capital Markets to any sovereign wealth fund, foreign bank, off-shore accounts and just about anyone who might be willing to pay a premium for access to our services, capital and unlimited liquidity.

- Use depositor cash to buy back as many of my outstanding shares as possible in order to goose EPS and consolidate wealth, not just for me, but most importantly, for all of the large block, insider share-holders whose voices have a direct and vociferous impact on the decision process of my board’s compensation committee.

….and that….my good friends is exactly what’s happened.

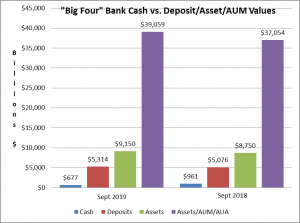

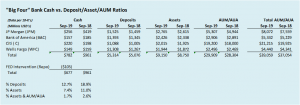

So let’s take a look at the combined balance sheet data of the “Four Horsemen of the Apocalypse” (JPM, C, BAC, and WFC). Again, we need to look at these banks in aggregate, since they are all now following the Chinese Capitalist model as “State Owned Enterprises” (SOEs)

The data below is from the 9/30/19 vs. 9/30/18 10-Q’s.

From the above figures we note the following:

- When we exclude the $105 Billion Repo Intervention, we see that the Four Horsemen were/are attempting to run a much bigger balance sheet with roughly $300 Billion less cash, voluntarily (because of their friendly FED relationship) or not (because of uncontrolled foreign deposit flight) subjecting themselves to a higher “run” exposure.

- The bulk of the decline (and presumably the replacement via Repo) in cash occurred at JPM ($163 Billion)

- Cash as a % of deposits has declined from 18.9% to 12.7%.

- Cash as a % of Assets has declined from 11.0% to 7.4%.

- Deposits (immediate potential cash requirements) increased by $238 Billion.

- Bank (Balance Sheet) Assets and Assets Under Management/Administration (AUM/AUA) combined, increased by a whopping $2 Trillion in the last year.

Now, just for fun, let’s take a look at what the Four Horsemen Balance Sheet data looks like when compared to December 2007, just prior to the Great Financial Crisis.

Deposits have doubled, Assets have increased by 50% and Assets/AUM/AUA have actually tripled (from $12.7 Trillion to $39.0 Trillion) at the Four Horsemen. Remember, the most important aspect of these Assets/AUM/AUA is that much of it can be used as “Rehypothecated Collateral”. (We’ll discuss this in a little more detail farther along in this post)

From the above, even though we note that the ratio of cash balances to Deposits/Assets/AUM/AUA have all increased, I might suggest that since international business is highly concentrated in these banks, therefore, domestic deposits (those deposits controlled by US Entities and individuals) in these institutions must be rapidly on the decline, replaced by deposits and US Dollar Assets controlled by foreign individuals and entities, when compared to other US Banks . (See: BIS data below)

Total deposits for the Four Horsemen have remained constant at roughly 40% of Total US Commercial Bank Deposits (2019-$5.3T/$13.0T vs. 2007-$2.7T/$6.7T). Four Horsemen Balance Sheet Assets have also remained relatively constant at 55% of Total US Bank Assets (2019-$9.1T/$17.5T vs 2007 $6.0T/$10.9T) since the Great Financial Crisis, but again, since these banks are the four largest, primary US/International banks handling a significant load of the foreign ownership and financing of foreign purchases of US Assets and Real Estate, a significant amount of these deposits and Assets must, by definition, be comprised of money from non-US Customers.

Next, given the FED “Repo tool” made available to the banks at the end of September, we can also presume that the level of “Window-dressing” in the financial statements on September 30th (and quarter ends going forward), when compared to what the balance sheet might look like on any given inter-period day, will be at best extremely favorable and at worst, a potentially misleading picture of what the real financial condition of these institutions actually is. i.e.) as foreign deposits flee the Four Horsemen, and US Customer deposits remain constant, the cash can only be replaced by the FED and the financial statements will reflect phantom liquidity which, if not for FED intervention at quarter and year end, would never exist. Thank goodness the FED has their collective backs….no matter what.

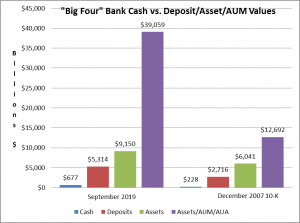

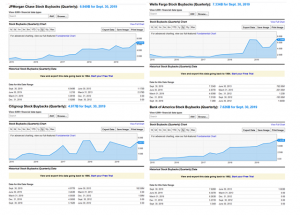

Buy Backs!

I also mentioned that if I were a titan of finance, with an unlimited Repo facility at my disposal, I’d have no problem using depositors money to buy back my shares. Again, that’s exactly what the Four Horsemen have done. Over the last year (Sept. 2018 thru Sept. 2019) the banks bought back $89.4 Billion of their own shares. (WFC $23.9B, BAC $25.5B, C $17.1B, JPM $23.1B) Of course these buybacks accomplish two really important objectives. 1.) They goosed EPS, and 2.) They concentrate control and value in the remaining insider held shares.

I’d emphasize that if a middle market bank in the Midwest did anything like this, and ran into liquidity problems, rather than given access to short term funding, they would more likely be put on FDIC/FED watch and eventually closed or forcibly merged, most likely into one of the Four Horsemen, who happen to have unlimited FED funding. In fact, that’s what’s been happening for years. Seems a bit inconsistent, almost anti-competitive or even “socialist”, doesn’t it?

https://ycharts.com/companies/JPM/stock_buyback

https://ycharts.com/companies/C/stock_buyback

https://ycharts.com/companies/BAC/stock_buyback

https://ycharts.com/companies/WFC/stock_buyback

BIS Data

On December 8th the Bank of International Settlements released its June 30th data re: offshore dollar deposits. Again, with BIS data, we are forced to look in the rear view mirror, but its worthwhile to note that the trend of US Dollar deposits being accumulated and held by foreign entities (leaving the US Banking System) is continuing and in fact accelerating. Foreign owned, offshore US Dollar Deposits/Liabilities increased $199 Billion (1.3%) to $15.081 Trillion from $14.882 Trillion in the March Quarter. If I were to guess, I’d think that the September Quarter trend continued and US Dollar off shore movement increased by at least another $200 Billion, thus extending the pressure on the Four Horsemen to come up with cash, contributing to and/or at least partially causing the need for the September Fed/Repo facility. The FED, per Secretary Mnuchin’s Christmas Eve 2018 instruction, is more than happy to “print” the money, fully funding the off-shore escape of the US Dollar from the US Banking System and hence, the US Main Street economy.

https://stats.bis.org/statx/srs/table/A5?c=5A&p=

DTCC & FICC – Potential “Choke Point”

Most investors, unless they are involved in the back office, magical transaction-matching side of finance have no idea who/what DTCC/FICC (Depository Trust Clearing Corporation/Fixed Income Clearing Corporation) actually is or does. I first wrote about DTCC/FICC back in 2016. If you have any interest in my commentary on their “hugeness” back then, feel free to read my work from that time. If you are more interested in the current “humongous-hugeness” of the business feel free to read on. Since everything is a matter of perspective, let’s start out with what they say they do, per their website:

“Risk management is the primary function of DTCC and has been since the organization’s inception more than 40 years ago. The company’s risk management role entails effective and efficient identification, measurement, monitoring and control of credit, market, liquidity, systemic, operational and other risks for the DTCC enterprise, its users and the marketplace.”

Yup….that’s what it actually says.

My take on this, as you might suspect, is a bit different from the above. The best description of this business I can think of, off hand, is actually from the video clip below. They are the IT intermediary facilitating the light speed movement of slices of cake around the planet. (Bonfire of the Vanities, 1990)

My perspective is that this little tiny, privately held, industry-owned service provider, which handled and cleared roughly $2.2 Quadrillion in notional value (more than $8 Trillion per banking day) of securities/loans in 2019, is a bit like an Online Trading Platform (i.e. like your on-line account at E-trade, Fidelity or Schwab, etc.) for MIT & Ivy League trained quant-money managers running algos. There are roughly 1,000 “Sponsoring Members” (Primarily Banks) who control access to the system and vet “Sponsored Members” who would be authorized to access the system/markets/platforms with the permission and authorization of the “Sponsoring Member“. Think of it as you (Sponsoring Member) giving your cousin (Sponsored Member who you know pretty well and trust) account access and your password to make trades. He/she makes the decisions but you, the Sponsoring Member, are on the hook if he/she screws up.

Of course, these digitized securities never actually go anywhere. They don’t move. They sit in a depository somewhere, perhaps one of the Four Horesmen, while DTCC/FICC processes the ownership change transactions and authorizes/remits netted funds based on the trades back to the buyers and sellers at light speed.

As an aside, I have to wonder, philosophically, why the global financial system actually needs quadrillions of US Dollars, rehypothecated repository collateral and the associated commitments to close/pay flying around the globe at light speed, between self regulated banks, fund managers and counter-parties “loaning” their reputation and credit worthiness out to international, ShellCo Hedge Fund customers and investors where recourse rights, recovery and resolution in the event of a default might be complex, if not impossible to define or enforce. Perhaps it’s just me. I’m sure everything is just fine and dandy.

When we examine the most current 2018 DTCC financial statements we find that this business generated $299 million in net income on $1.7 Billion in revenue. The business has $47 Billion of Assets, almost all of which is comprised of Member/participant margin/deposit/funds. i.e.) in order to clear $8 Trillion a day these members need to post a very reasonable 0.5% of that amount with DTCC as “good faith” earnest money, just to be sure these transactions close. Thank goodness markets for all of these assets are stable and could rarely, if ever, have a 50 basis point, leveraged swing in any given day. (….that was an attempt at a “joke”)

The business has also accumulated roughly $2 Billion of Shareholder Equity over the years. Revenue per dollar of trading/transaction volume is 0.00009% ($1.7 Billion of Revenue earned for processing $1.854 Quadrillion Transaction volume) As an industry sponsored service provider/organization, the goal seems to be to process the trades/transactions at a break-even while funding future capital/technology cost.

There is also a really nice write up and time line in the 2008 financial statements about how DTCC Management apparently saved the world from the Lehman failure by taking significant pro-active, last minute action to prevent the world from ending. I encourage you to read it. (Link: http://www.dtcc.com/about/annual-report )

I might ask, after reading the DTCC version of the Lehman debacle, and Ben Bernanke’s Reflections of the GFC side by side, that even though this was the largest account close out in history ($500 Billion) and none of the DTCC clients apparently lost any of their clearing funds/deposits, might it have been better to monitor the situation a little more closely, perhaps pumping the brakes months ahead, weening the world off of Lehman account exposure, rather than just effectively taking control a few days before the bankruptcy filing? Hindsight is always 20/20 I guess. After all, nothing like this had ever happened before. The DTCC risk managers, though talented brilliant managers, might have just gotten lucky and could just as easily have stumbled into something much different, where the wind-down of these assets ensnared dozens of members and their impacted counter-parties with illiquid assets to be repriced and wound down actually multiples of what it was. Id also suggest, that based on Bernanke’s comments and the economic losses incurred by just about every man, woman and child in America, that again, it might have been much worse.

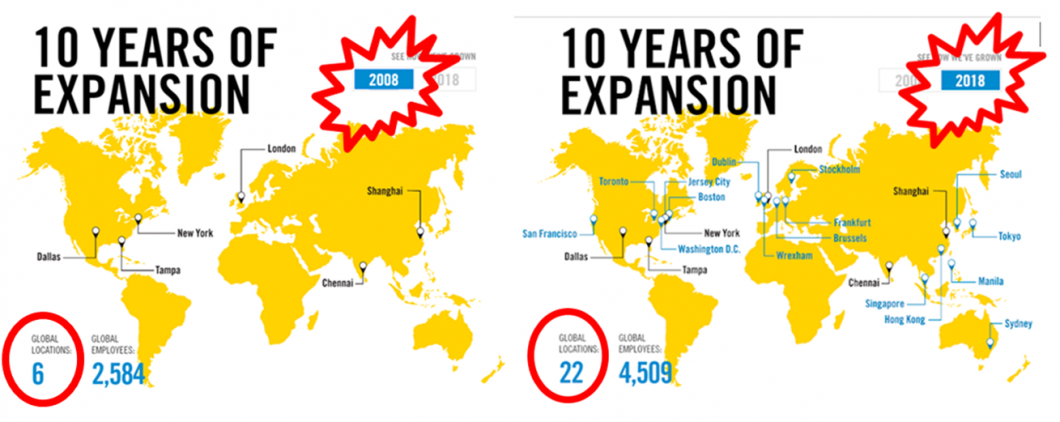

Now let’s take a look at what’s happened to their business since DTCC/FICC successfully navigated their way through the Lehman debacle. It’s been nothing short of miraculous. In 2008 they had three foreign offices (London, Shanghai and Chennai) with roughly 2,600 wonderful, hard working employees. Let’s consider the below our “starting point to the upcoming financial Armageddon”.

Now, when we fast forward to 2018 (graphic on the above right), per the most current financial report, DTCC now has 15 foreign offices (Toronto, Dublin, Wresham, London, Brussels, Frankfort, Stockholm, Chennai, Singapore, Hong Kong, Shanghai, Seoul, Tokyo, Manila and Sydney) in 13 foreign countries. This incredible expansion has been accomplished presumably by providing foreign banks and investors access to US Capital markets and US Dollars via their platform(s). From their 2018 Financial Report we see that they’ve processed $1.854 Quadrillion (not a typo) of Securities that year and are on track at the current growth rate to have processed (give or take) $2.2 Quadrillion in 2019. This is a truly amazing growth story.

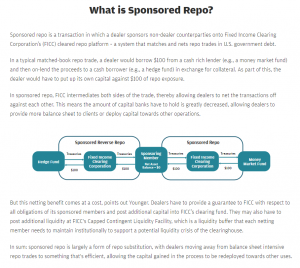

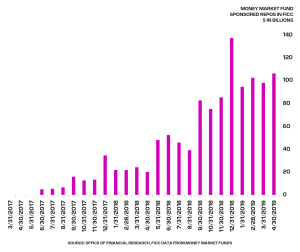

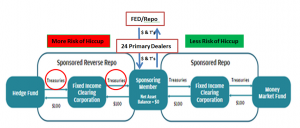

The gang-buster market/product they’ve developed and proliferated around the globe, through their platform of Global Access products (GMEI, CONNECT, CTM, OASIS and TradeSuite ID, etc.) provide the automated “front end” for the evolution of another, rapidly proliferating financial tool, i.e.) the “Sponsored Repo“, which, in general terms is the opening up of the Repo Market to non-Bank, International Financial/Shadow institutions. Generally speaking, again, the DTCC/FICC products are a Quasi-E-Trade-like platform where brilliant MIT and Ivy League Quants, foreign bankers and sovereign wealth funds can finance longer term bets with other traders/gamblers with a steady stream of cheap, freshly printed, overnight money from US Money Market Funds and Banks, who are likely led to believe they are dealing with another US Bank or a dealer. In reality, the the “Sponsoring FICC/DTCC Member” can be acting as an intermediary between the money market and the “Sponsored Member“, actually loaning their money overnight to a hedge fund, foreign bank, or any other investor the Sponsoring FICC/DTCC Member chooses to sign up and “sponsor”. The following graphic describes the general construction of a “Sponsored Repo”.

First, let’s take a look at what DTCC says about the risk level surrounding Sponsored Repo in their customer posted November 21, 2019 response Concerns about Sponsored Repo Miss the Mark to negative commentary cited in Bloomberg and Risk articles. The two comments in the article that really grabbed my attention were:

DTCC Comment: “New participants remain a small part of the overall market. In GCF Repo, these participants make up about 6 percent of total gross activity in the last quarter of 2018. Similarly, in FICC DvP, new repo participants are 3 percent of total gross activity for the same time period. As a point of reference, the average amount of GCF Repo and FICC DvP activity for a top-ten dealer is larger than the sum of the repo activity for all new participants.”

My comment: From a recent June 30th, 2018 Press Release “Although DTCC’s subsidiary Fixed Income Clearing Corporation (FICC) has operated its Sponsored DVP Repo Service since 2005, it only expanded participation in this service beyond Registered Investment Companies (RICs) in May 2017.” In addition, JP Morgan didn’t come on line in Sponsored Repo until Q2 2019. So I guess it’s just a matter of perspective, in my humble opinion, the demand for this product seems to be off the charts. If I had launched ANY properly priced product that, in just a few months after launch, had captured 6% of ANY established market I’d be throwing a party. BNY Mellon seems to agree in their marketing piece describing Sponsored Repo as “surging” at roughly $100 Billion a month back in the Spring of 2019.

DTCC Comment: “Now that repo is better understood by the general public, everyone has an opinion. But as we told the AV guy at our Rates & Repo 2019 conference last week, if you’re looking for the source of the next crisis, it’s not likely to be found in repo so long as the Fed is around. ”

My Comment: I guess I’d agree with the above as long as we believe that the “Fed is always going to be around”. I’d also change “the Fed” to the “Us Taxpayer” to be technically more accurate.

Anyway, let’s take a peek at exactly what Sponsored Repo really is and why it presents, in my humble opinion, significant systemic risk. Here’s a really simplified, edited version of the previous DTCC chart (below) describing the extremely simplified, general structure of what’s happening.

So let’s analyze what’s really happening in the chart above:

- Likely, the transactions in the middle are “good as gold”. The FED doles out cash to the Dealers in exchange for Treasuries based on daily demand. The Money Market Funds exchange cash for treasuries. The Primary dealers and Sponsoring Members pass the cash through, again in exchange for Treasuries. The transactions reverse the next day/week/month, and we start over. The Green Side Less Risk of a Hiccup “triangle” on the right, from the FED through the dealers and Sponsoring Members through the Money Market Funds illustrates the way things used to be.

- The Sponsoring Member is a also a pass through entity, sending low cost money on to Sponsored Members with little/no capital requirement. (transactions are netted) Of course, none of these “pieces of paper” actually go anywhere, the transactions are book entry at the respective repository/custodian. (i.e. This is the matching and record keeping DTCC/FICC accomplishes)

- The 24 FED Primary dealers are there for a backstop, either to loan Repo money to Sponsoring Members or take in extra cash via the Reverse Repo facility from the Sponsoring Members. (Note: that Reverse-Repo activity has been comparatively non-existent)

- The right side of the chart (Less Risk of a Hiccup) is almost always a “pass through” of Cash to Dealers in exchange for Treasuries. On the left (More Risk of a Hiccup) side we have (focusing on the “red circles”) a slightly less accurate portrayal of what’s actually happening with the Trillions of dollars of these transactions that happen every day. I’d suggest that it’s simply not possible for all (or anything close to all) of these transactions to be exchanges of cash for US Treasury Securities. There simply aren’t enough Marketable Treasury Securities in existence (only $16.7 Trillion) to fulfill the demand. If the graphic were accurate the entire inventory of US Treasuries would turn over in two banking days. I’d suggest that perhaps, the collateral changing hands on the left side (More Risk of a Hiccup) between Sponsoring Members and Sponsored Members could be all sorts of “other” collateral, which we’ll discuss shortly.

- The spreads (and fees) are presumably extremely profitable for Sponsoring Members. The Sponsoring Member uses its impeccable credit rating to borrow and immediately loan out the money to investors/borrowers who are not, for whatever reason, full fledged “Members“. Think of it as a wholesaler/retailer relationship.

- Because of “rehypothecation” these “capital free” (netted) transactions can be even more profitable for the Sponsoring Member. Under US SEC Rules, Banks/Dealers (Many DTCC/FICC Sponsoring Members) are able to “reuse” collateral up to 140% of the “loan”. i.e.) For every $1.4 Billion borrowed, they only need to provide net $1 Billion of “clean” collateral ($400 Million can be “reused” collateral). In a relatively recent (2018) study of America’s largest banks and dealers, the Fed concluded that roughly 85% of all collateral provided in Secured Financing Transactions (SFTs) that flows in, simultaneously flows out, an indication that rehypothecated collateral, at least at the time of the study was not creating significant “collateral chains” of “re-used” collateral, as we recall was one of the complicating factors in the Lehman bankruptcy (multiple claims on the same collateral). In effect, Dealers (aka “Big Banks”), at the time of the study, were converting, at any given point in time, roughly $1 Trillion of what should be secured financing, to unsecured “rehypothecated” financing, because of collateral reuse. i.e.) multiple claims against the same asset. The study implies/concludes that this would seem reasonable (safe) given the quality of the collateral, financial condition of the dealers and their direct access to FED liquidity. A 2018 ECB study illustrates similar concerns over increasing rehypothecation (collateral “reuse”) for the large European banks and comes to a similar “all is well” conclusion. (I’d invite you to read the studies to get a feel for the process, or better yet, I’d be grateful to see updated studies for both the FED and ECB that might confirm that rehypothecation is “still” not a problem.)

- As a parallel, if you or I took out a mortgage on our home and failed to disclose a prior mortgage or two on this collateral to the new lender and defaulted, it would be considered “mortgage fraud”. I doubt that we’d prevail in the lawsuit by claiming it was just “rehypothecation”.

In their quest for new customers and the associated volume, fees and participation, DTCC has been apparently scouring the globe via their fifteen new International Offices in search of new Sponsoring/Sponsored Members, filling the financial/liquidity needs of money managers everywhere.

That’s right, in theory, this is just speculation of course, I know bankers would ever do anything like this, but for the right price, every international rogue regime bank, money launderer, hedge fund, drug dealer and smuggler, through its relationship with a seemingly legitimate Sponsored financial institution, can set up anonymous offshore accounts with a Sponsoring Member through the rapidly expanding DTCC/FICC member directory and begin moving dump truck loads of US Dollars around the world at the speed of light. All they have to do is figure out how to get through the initial DTCC/FICC vetting process. I’m sure, because of the level of fines incurred since the GFC (table above/left), that at least the bigger banks have gotten religion, seen the error of their ways and would never allow any high risk, untoward behavior on their watch.

That’s right, in theory, this is just speculation of course, I know bankers would ever do anything like this, but for the right price, every international rogue regime bank, money launderer, hedge fund, drug dealer and smuggler, through its relationship with a seemingly legitimate Sponsored financial institution, can set up anonymous offshore accounts with a Sponsoring Member through the rapidly expanding DTCC/FICC member directory and begin moving dump truck loads of US Dollars around the world at the speed of light. All they have to do is figure out how to get through the initial DTCC/FICC vetting process. I’m sure, because of the level of fines incurred since the GFC (table above/left), that at least the bigger banks have gotten religion, seen the error of their ways and would never allow any high risk, untoward behavior on their watch.

When we examine DTCC transaction volume in the chart below, over the last decade, we see that volume dropped precipitously after the GFC. Presumably both the credit quality of both the collateral and participants improved. Of course, the easy explanation here is that once investors got their little fingers burned they backed away from the stove for a while. The volume picked up a bit to $1.7 Quadrillion in 2011 likely reflecting the recovering of a healthy financial system and then, for whatever reason, began gradually declining until 2016. Beginning in 2017, again guessing/theorizing on the timeline, opening of the global offices, newer Sponsored Repo products, particularly Chinese “boomerang dollars” (US Dollars and assets that remain under control of the Chinese Communist Party) began to make their way into the DTCC/FICC system through Sponsored Member sub-accounts/customers of for example, the Bank of China, ICBC, HSBC, Deutsche Bank, etc. It was most likely a trickle at first and increased steadily as access and Sponsorship accelerated.

Recent DTCC/FICC SEC Filings

To illustrate the direction this is going, DTCC recently filed two documents with the SEC, both intended to further the volume and presumably the expansion of the foreign Sponsorship trend and promote access to all sorts of wonderful new customers, most of which are probably financially stable solid corporate citizens. Others, again just speculating here, are perhaps really sneaky organizations of questionable origin and dubious intention, contributing to the very profitable effort by Sponsoring and Sponsored Members to broaden access to the Western Financial System.

FICC-2019-007 (Filed: 12/27/19) This filing provides a mechanism by which a Sponsoring Member (For example, Bank of China, ICBC, HSBC, etc.) would be responsible for managing the wind down of the Sponsored Member’s (For Example, a controlled Chinese Hedge Fund/Investor) positions in the event of a default. Notification requirements to FICC are reduced, generally left to the Sponsoring Member (Chinese Bank’s) discretion. The liquidation/wind-down decision process in the event of a Sponsored Member default is currently managed by FICC rather than the Sponsoring Member (Chinese Bank). This filing shifts the process and responsibility away from DTCC/FICC. IMHO the unintended result of this filing is to allow and defaulting Sponsored Member (Chinese Investor) to kick the can down the road through bi-lateral negotiations with the Sponsoring Member (Chinese Bank) and allow it to be covered up by the Sponsoring Member (Chinese Bank) until it goes “Lehman” on our ass.

FICC-2019-006 (Filed: 12/16/19) FICC removed the requirement that foreign outside counsel provide an annual opinion on the legal status and compliance with home jurisdiction and US law, providing that a periodic opinion (and fee schedule) would be provided by FICC counsel, ostensibly to eliminate duplication and costs to sponsored foreign members and enhance compliance with FICC requirements. It seems to be important to FICC, from a “blame delegation” and liability perspective, to know as little as possible about these foreign Sponsoring Members and Sponsored Members, while simultaneously reducing their cost and paperwork. Hopefully, this isn’t just a rubber stamp, volume driven process and there is actually at least some skepticism and underwriting involved prior to allowing access. Again, it seems far too important to DTCC/FICC to break down barriers and make it as easy and effortless as possible to get these high-margin, foreign customers on the books as quickly as is practical. It seems to be more about globalization and breaking down barriers than national security.

http://www.dtcc.com/legal/sec-rule-filings

Not to worry though, I’m sure that the Four Horsemen, even though they are routinely fined billions of dollars by regulators for their shenanigans, as well as the Bank of China, ICBC, HSBC, Deutsche Bank the Swiss Banks and all of the other usual suspects have really upped their game and would never consider any international financial transactions with parties and partners that are reputed to be anything less than pristine pillars of financial integrity, or at least willing to pay out-sized fees to get the job done.

Remember the #1 rule of global finance…..

“Money….no matter what the source or origin…talks.”

Scope and Collateral Relationship

So, now let’s take a look at the left table and the graphic/chart below it. Through the incredible, herculean efforts of the FED, the Four Horsemen and our two custodian friends (Bank of New York Mellon and State Street Corporation), these seven institutions have, because of a misguided, ill-conceived monetary policy, managed, in just twelve short years to “create” an additional $61.9 Trillion of “collateral” which has absolutely no relationship to America’s “real” economy. So now let’s compare the amount of collateral to a couple of important metrics. The first, and most important comparison is to Marketable US Treasuries currently in circulation, many of which are included in the $116.3 Trillion US Assets/Assets Under Custody/Assets Under Administration/Assets Under Management at the six largest Banks/Custodians in America. The most disconcerting thing here is that there is now roughly $100 Trillion of additional marketable collateral, comprised of all sorts of wonderful securities that can (and do) comprise the collateral flying around on the left (More Risk of a Hiccup) Sponsored side of the DTCC/FICC chart above. By definition, if we consider US Treasuries as risk -free, the additional $100 Trillion would have a gradation of risk, from AAA Corporate Debt, to Munis, to CLO’s, to Junk, to Tehran Airport Development Bonds, etc. We can assume that the absolute volume on the More Risk of a Hiccup end of the $116 Trillion risk spectrum is comprised of assets a bit more risky and less liquid, than US Treasuries and AAA Corporate debt. (My guess is that those Tehran Airport Development Bonds would take quite a haircut in a liquidity crunch. I’ll explain the mechanics of this acceleration below. To put the size of this mountain in perspective, if we estimate that total assets held in US Custodial Accounts (whether foreign or domestic) are currently estimated at roughly $130 Trillion, and available as collateral and marketable/trade-able, therefore nearly 90% (+/-) of America’s collateral is concentrated in (or held by) these six institutions. To further put that figure in perspective, per the just released Financial Stability Board (FSB) 2019 Report (2018 Data), Global Financial Assets amounted to $375 Trillion, extrapolating at the current growth rate, we can estimate total Financial Assets around the globe are now somewhere around $400 Trillion. (The 2019 Financial Stability Board (FSB) (2018 Data) just came out….they are a little behind…lots of math) American Financial Institutions now have roughly 35% of all world’s financial assets under their Care Custody and Control, with roughly 85% of these assets residing in these same six custodian banks.

at the six largest Banks/Custodians in America. The most disconcerting thing here is that there is now roughly $100 Trillion of additional marketable collateral, comprised of all sorts of wonderful securities that can (and do) comprise the collateral flying around on the left (More Risk of a Hiccup) Sponsored side of the DTCC/FICC chart above. By definition, if we consider US Treasuries as risk -free, the additional $100 Trillion would have a gradation of risk, from AAA Corporate Debt, to Munis, to CLO’s, to Junk, to Tehran Airport Development Bonds, etc. We can assume that the absolute volume on the More Risk of a Hiccup end of the $116 Trillion risk spectrum is comprised of assets a bit more risky and less liquid, than US Treasuries and AAA Corporate debt. (My guess is that those Tehran Airport Development Bonds would take quite a haircut in a liquidity crunch. I’ll explain the mechanics of this acceleration below. To put the size of this mountain in perspective, if we estimate that total assets held in US Custodial Accounts (whether foreign or domestic) are currently estimated at roughly $130 Trillion, and available as collateral and marketable/trade-able, therefore nearly 90% (+/-) of America’s collateral is concentrated in (or held by) these six institutions. To further put that figure in perspective, per the just released Financial Stability Board (FSB) 2019 Report (2018 Data), Global Financial Assets amounted to $375 Trillion, extrapolating at the current growth rate, we can estimate total Financial Assets around the globe are now somewhere around $400 Trillion. (The 2019 Financial Stability Board (FSB) (2018 Data) just came out….they are a little behind…lots of math) American Financial Institutions now have roughly 35% of all world’s financial assets under their Care Custody and Control, with roughly 85% of these assets residing in these same six custodian banks.

The next  column, the “purple” column, in the chart represents the Non-Financial Business Earnings before Interest and Taxes of US Businesses for 2007 ($7.0 Trillion) and the four most recent quarters for 2019 ($6.9 Trillion) per the FRED chart on the immediate left.

column, the “purple” column, in the chart represents the Non-Financial Business Earnings before Interest and Taxes of US Businesses for 2007 ($7.0 Trillion) and the four most recent quarters for 2019 ($6.9 Trillion) per the FRED chart on the immediate left.

We note that, even in nominal terms, Non-Financial Business Earnings before Interest and Taxes has declined. Let’s take a minute and think about what this really means. The Non-Financial Business Earnings represents the effort of good hard working Americans who “build stuff” and “make stuff” that people want to buy. It’s the combined earnings, profits and success of the real work of real people, our neighbors and their businesses in America. You’d think, that after creating and deploying all of that $116.3 Trillion of capital, that these earnings and profits would be skyrocketing, through the roof and to the moon! Oddly enough, that’s not the case. The earnings per dollar of assets for 2007 was at 12.9% ($7T/$54.4T) compared to a less than robust 5.9% ($6.9T/$116.3T) today. Or put another way, the P/E for American business, as presented here, has gone from 7.8 in 2007 to 16.9 this year. The value of the Assets in existence has more than doubled in relation to earnings.

Finally, the teeny-tiny blue column, M1, the “grease”that keeps the $2.2 Quadrillion of settlements settling, flying around the world on a daily basis, has increased from$1.4 Trillion in 2007, supporting the $54.4 Trillion ($1 for every $39) of financial assets to $4.0 Trillion supporting $116.3 Trillion ($1 for every $29). I, for one am glad that we’re building a small cushion, just in case some of the “netting” between Sponsors goes off the rails and suddenly, for whatever reason, can’t be netted anymore. (see: Lehman Repo 105’s & 108’s). As Dave Eggers once said…. You shall know our Velocity! Speaking of which…..

Velocity….Open Heart Surgery with a Chainsaw…

Let’s take a look at the chart below and try to put some more things in perspective. It should be relatively clear to anyone with two functioning eyeballs (or even one) that something goofy happened to M1, and the velocity of same, right smack dab in the middle of the financial crisis. So let’s take a few paragraphs and take a stab at explaining what in the wide world happened. First, let’s take a quick refresh on what “Velocity” actually is. Velocity is defined as the number of times one dollar is spent to buy goods and services per unit of time.

If we look at what’s happened, in 2007 M1 Velocity was 10.7 (i.e. Every Dollar of M1 was spent 10.7 times during the quarter) compared to the current 2019 Velocity of 5.6 (i.e. Every Dollar of M1 was spent only 5.6 times during the quarter) on a much larger economy. Velocity, the speed at which people spend money has slowed. Put another way, if velocity remained constant from 2007, our economy would only need M1 of $2.0 Trillion today, rather then the $4 Trillion actually in circulation. The chart compares both Velocity and M1, indexed to 12/31/2000 =100. It illustrates how and why velocity has slowed. The relationship between M1 and Velocity (the “real” economy) remained relatively constant from 2000 through 2007 and began to diverge during the GFC. People were frightened, they were hoarding cash and keeping extra rainy day money in their checking accounts. This would make sense, but after a few years, we might have thought that, after the financial system would become normalized, Velocity and M1 would have reverted to the mean, or prior stasis. As we can see that didn’t happen. As time went by it became clear that we had moved on to a different, more permanent model. Here’s what used to happen in the “good old days” when the money supply had at least some relationship to the “real” economy:

- Mike borrows money from the bank

- He gives Sandy her paycheck

- Sandy spends it at Fred’s grocery store

- Fred pays Jim, the meat guy for meat

- Jim buys another cow from Henrietta the farmer

- Henrietta buys feed corn from Angelo

- Angelo buys a new Pizza oven from Ricky

- Ricky pays his children’s tuition at Maple Grove school

- Maple Grove school gives Nelson, one of their teachers, his paycheck

- Nelson buys a new iPhone from Apple

- Apple pays Foxconn for the iPhone and the money ends up at the bank of China

And that’s how we get to a velocity of 10.7 in 2007. All sorts of goods and services are sold and paid for using M1. The money stays in domestic US Checking accounts ready to be spent and re-spent.

Conversely, let’s look at how we got to a velocity of only 5.6 in 2019. There have been accelerating transaction chains I’ll refer to as “the bad new days“, described below, taking place over the last decade:

- The FED makes a loan to Nick at JPM Chase

- Nick makes a loan to a Arnold, a Sponsoring Member

- Arnold makes a loan to a Hedge Fund a Sponsored Member

- The Hedge Fund buys bonds from Heinrich at Deutsche Bank

- Heinrich buys USTs from Vladimir at VT Bank

- Vladimir buys US Municipal Bonds from Xi

- Xi loans money to CPC Members to buy NYC Condos

- The Seller of the condos deposits the money at JPM, and requests that the money be wired to Hong Kong and then on the the Bank of China.

Note that none of the “bad new days” transactions above, since they don’t involve the purchase of goods and services impact velocity, yet they all require (and eat into) usable M1. When we examine the “good old days” transactions we see that “ownership” of the money changes hands with every transaction. M1 is exchanged for goods or services. The transaction is “closed”. Every transaction is an increase in the recipient’s cash account in exchange for income. In contrast, the “bad new days” transactions all come with strings attached. These transactions, loans, bonds, securities, etc. remain “open” for the life of the associated asset/security and eventually need to be “closed out” at some point in the future. i.e.) If I loan you a million dollars and then you loan it back to me at a higher interest rate than I charged you, we are in the net same economic position we were in before we consummated the transaction. I still have my million dollars in cash, but you’ve made a (net) few bucks in interest. Moreover, we’ve created $2 million dollars of “new” Financial Assets, offset by $2 million of financial liabilities. I have a loan receivable from you and you have a loan receivable from me, which can be used as collateral for more loans. Again, we are in the same relative position we were in before we made the loans to each other. I have cash and a liability (I have to pay you back) and you have a Financial Asset and a Financial Liability (you have to pay me back). So instead of just having $1 million of cash in our two person economy, we now have an additional $2 million of financial assets (loans) that can develop into a never ending collateral chain of all sorts of AAA rated loans, expanding our economy, since neither you, not I, would ever default. Interestingly enough, the only similarity between the “good old days” and the “bad new days” in the example above, is that the money eventually finds its way to China.

Apparently, the FED, when faced with the epiphany of the Great Financial Crisis, embraced a philosophical shift as to what “money” really is and/or should be. Money it seems, is no longer just a high velocity tool to conduct commerce, pay wages and transfer wealth on main street America. Money has evolved. Money is now becoming, primarily, a low velocity store of value, used to actually create financial assets and wealth. At the trough of the GFC, the dollar was king, becoming even more regal and royal. US Investors, as well as the elite leadership in collapsing/struggling economies and regimes chose to abandon their own devaluing currencies and dog-shit financial assets, using the US dollar, US dollar denominated assets, our rule of law and anonymous off-shore tax havens as a safe, reliable repository for the spoils and treasure of the pillaging of their own economies. This phenomenon did not go unnoticed by the Chinese Communist Party.

“Collateral” Damage

Again, by definition, “risk free” Marketable US Treasuries account for only about 10% of all US Dollar denominated Financial Assets, so the other 90% of these Assets (again by definition) must be comprised of Assets which are “more risky”. i.e.) Subject to more rapid, violent changes in value and quickly discounted and/or abandoned when times get tough. The myriad asset classes and varying composition of the $2.2 Quadrillion (and rapidly expanding) of collateral flying around the globe, at least to me, is mind boggling.

Of course, this behemoth financial monstrosity doesn’t just happen by accident. It takes a dedicated, relentless effort by an army of lawyers, lobbyists, politicians, technocrats, technicians and tycoons to accomplish anything this elaborate. This is what our “win at all cost” system has wrought. Bankers, Investors, Traders and their Institutions, in order to get an edge, are more willing than ever to straddle the line, cut a few corners, misrepresent an irrelevant detail or two and/or spin a tale in a particular way to gain an edge and make a couple of bucks. “Hey, everyone is doing it, I want my slice of the pie!”

Let me also be clear. What we have here is not illegal. Nothing that’s discussed today, at least that I’m aware of, both because these activities are not illegal per se (and by design), and because when these systemic calamities occur, the transactions are structured to create a void of accountability and limit individual and organizational liability from the eventual implosion, constitutes any wrong-doing. If you spend virtually unlimited resources and years lobbying to legalize robbing liquor stores, we should not be surprised that after finally passing the law that we have an outbreak of liquor store robberies. The system, by virtue of its complexity and design, eventually makes it inevitable that under-vetted, incompetent or bad actors enter the fray, making huge errors, mistakes and misjudgments, or even conduct strategically coordinated systemic activity, at a significant, temporary profit to the helpers. The human cogs, pushing the paper in the machine, would swear that what they doing is just fine. They are building their businesses, expanding their markets, deploying cutting edge technology, bigger, faster, better and “going where no banker has gone before”. They would say that what’s happening is not immoral….it’s capitalism. There is likely no malice or intent to hurt anyone on the part of the “helpers“. From their point of view, what’s the harm if we “take a few crumbs from that slice of cake?” We’re just taking advantage of the extremely favorable rules of the game which, through a decade of industry lobbying, we’ve been able to craft in our favor. Moreover, if we think we can “improve the system” a little more, removing any question of our culpability or responsibility for what’s about to happen, we’re sure as hell going to do it.

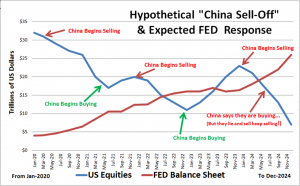

As I’ve opined often in prior posts, ever since Hank Paulson made his first trips to Beijing, back in the early throes of the Last Great Financial Crisis, begging for money and inadvertently teaching the Chinese bankers how to destroy the Western Financial System, the Chinese Communist Party has been stealthily working to upend America’s global dollar hegemony with their eventual goal being to float the RMB at a favorable exchange rate. Their primary tool will be a continuous, roller coaster ride “Pump and Dump” with the eventual end game resulting in the collapse of Western Financial Markets. To illustrate, let’s take a look at the graphic below. I had published a tabular version of this model in May of 2019 in the post entitled “Our Inevitable Monetary Journey” which I’ve also posted below.

First, the disclaimer from my May of 2019 post:

“My forecast of the USD Money Supply and US Macro-Asset Categories over the next five years using Great Financial Crisis data as a base. These changes/flows could take place over the next six months (ouch) or the next decade (we won’t even know what happened). Five years is represented.”

Let’s take a look.

So what do we have here?

The simple graphic above represents two, more granular, quarterly plots of the table below it, “FED Balance Sheet” RED and “US Equities” BLUE (aggregate US Stock markets) levels in Trillions of dollars through 2024. The important concept described here is that, as the Chinese Communist Party continues to accumulate dollars through their persistent trade surplus as well as their siphoning of US Dollars through their disruptive sale of US Financial Assets, American Financial Market indexes will begin to resemble a downward skewing/spiraling sine wave, trending skyward as the Chinese “Pump” ….and careening South as the Chinese “Dump”. Let’s take a look at the hypothetical inflection points.

- As the CPC begins selling, per the illustration, Stocks will decline steadily from roughly $33 Trillion today, at the beginning of the cycle, down to $17 Trillion (a 50% decline) through June of 2021. During that same period the FED’s Balance Sheet will increase from the $3.9 Trillion today to about $10 Trillion.

- At the first trough the CPC begins buying once again (they know a good deal when they see one!) and markets recover to $20 Trillion by January of 2022. FED stimulus moderates slightly as the market recovers and the Balance Sheet increases to $12 Trillion. (What’s a Trillion here or there among friends when we’re courting financial collapse?)

- At the peak of that cycle the CPC begins selling again, through November of 2022 and Stock Markets fall to $11 Trillion. During the same period the FED adds another $4 Trillion of Balance Sheet, taking it up to $16 Trillion. The FED is now fully trained.

- Again, at the bottom of the cycle, the CPC starts buying again, sending the Markets back up to $23 Trillion by January of 2024. The FED stimulus moderates during the period, increasing the Balance Sheet a comparatively minuscule $2 Trillion to $18 Trillion.

- Finally, at the January 2024 peak, the CPC starts selling relentlessly, accumulating dollars as markets fall, eventually stocks settle at $6 Trillion in December of 2024, an 80% decline from their peak today. The FED’s Balance Sheet has ballooned to $26 Trillion, and the Western Financial System has been effectively torn asunder. America, the dollar and the world has to regroup.

It’s also important to understand that when this unwinding begins, all asset classes, everywhere in the world, (except for China) will be impacted. The table above “Proforma US Asset Behavior During the Next Financial Crisis (NFC)” describes whipsaw movements in Real Estate values, M3 and the credit markets (bonds) as well as Stocks and the Fed Balance Sheet. We know with certainty that he current $400 Trillion in global Asset values will be reset, increasing while China is “buying” and decreasing while China is “selling”.

Again, we have no way of determining when these buying/selling cycles will start and stop nor can we predict the level of pricing brutality involved in the selling, nor the level of exuberance erupting in the buying. The amplitude and period of our sine wave could vary unpredictably. The guiding principle, I believe that our Chinese “investors” will follow, again, with the end game being full, coordinated control of the US Financial Markets and the dollar. They will sell to the point where the FED participates in expansion and begin buying stocks again when the stimulus slows. (i.e.) They won’t want the FED to throw in the towel. They’ll want the FED to believe that by continuously expanding the Money Supply they are actually doing some good and “saving the main street economy”, as their wonderful models will indicate….. when in reality, they will be selling America to the Chinese Communist Party at a deep discount)

There are also recent signs that the FED, I’m sure through the urging and support of many of our finest Wall Street helpers and indomitable, perennial “winners“, many with significant Chinese sponsored skin in the game, is still willing to listen to just about any well thought out proposal subtly promulgated by these pro-China intermediaries. In a Wall Street Journal article last week, it was reported that the FED is actually considering opening up direct access to the Repo Facility to Hedge Funds and other qualified investors. So apparently, Hedge Funds are now considered to be Systemically Important, Too Big to Fail Institutions as well? Or is it just that the FED likes to fire up its chainsaw and slice through a few arteries every chance it gets.

Helpers!

“What would you think if I sang out of tune?

Would you stand up and walk out on me?

Lend me your ears and I’ll sing you a song

And I’ll try not to sing out of key…

Oh, I get by with a little help from my friends…..”

Ringo Starr

Today, US Equity Markets are sitting at a value of roughly $33.8 Trillion or 157% of US GDP. They’ve added about $2.2 Trillion in just the last two months, again with flat, at best, “real main street earnings”. The Shiller CAPE is currently at about 32, the third highest level in history, higher than both Black Monday and Black Tuesday, surpassed only by the 1999 Dot-Com Bubble (44) and Q3-2018 (33), just prior to the CPC testing of their ability to impact markets and probable/gauged FED response, prompting Steve Mnuchin’s Christmas Eve letter mentioned/discussed above. Equity valuations have been disengaged from Real earnings for quite some time. Incredible.

Another important building block of this CPC Global Pump & Dump is that value is concentrated in a few high value targets. i.e.) The shock and awe associated with the sudden destruction of value of an iconic, widely held American stock, like one (or several) of the F-MAGA stocks (Facebook, Microsoft, Apple, Google & Amazon). Note: The F-MAGA moniker would indicate that the Chinese Government, although it’s trying to destroy us, is not without its sense of humor.

At the time of this writing, the combined Market Cap of the F-MAGA stocks is $5.22 Trillion or roughly 15% of the current valuation of all US Equities. These stocks are the equivalent of the Pacific Fleet floating safe and secure on their Pearl Harbor moorings, without air cover, on December 6th, 1941. i.e.) These stocks are in every fund, ETF, Pension, 401k, index, etc. Everyone in America has direct or indirect exposure to these valuations.

Today, every Hedge Fund, Pension Fund, Mutual Fund and presumably every money manager of any significance whatsoever, likely has either offices in China, Chinese management, specialists, access to Chinese advice, proprietary Chinese market research and/or market intelligence. Given that the object of the game is to “win” they’d be absolutely foolish not own or at least have access to these resources. Winners need an edge. That said, as I also mentioned earlier, the CPC has been recruiting and deploying lots of willing “helpers” to accomplish their master plan. Again, we can presume that over decades all of these embedded agents, operatives and highly compensated helpers and resources have been feverishly working to shape the political and financial battlefield, gaining strategic advantages, globalizing and opening up America’s banks and financial system while simultaneously insulating the Chinese economy and currency from the rest of the world’s impending tumult. The CPC has successfully accumulated, by exchanging their people’s under-priced slave labor for technology and hard assets, all of the benefits of globalization while bearing little of the cost and none of the risk.

We Westerners continually make the mistake of trying to apply our economic, free enterprise model to the Chinese economy. We can’t and shouldn’t. Because China’s economy is isolated, there can be no economic default in the Chinese financial/economic model. Western resources (technology and capital) flow in at a discount and Chinese resources (iPhones, cheap plastic stuff on Amazon and Walmart storefronts, OBOR “deals”, etc.) flow out at a premium (trade surplus). Our bankers leap at ideas like buying China’s “bad assets” as a money making scheme, without considering the longer term consequences of allowing the Four Horsemen to exchange US Dollar liquidity for bad paper, securitizing it and selling it, creating more collateral pedaled to naive investors around the globe. This is the mechanism that has allowed the Chinese Communist party to steal and control the previously discussed $30 Trillion+ (and growing) armory of Financial weaponry pointed right at our financial system.

Again, on the mainland, defaults are political in nature, not economic. China Inc. doesn’t default because they can’t pay. They default because they don’t want to pay or won’t pay. There’s a distinct, strategic difference.

When a Chinese business fails, it’s because the Party has lost faith in the businesses, leadership, or simply because of strategic political expediency. There are no real property rights or rule of law on the mainland. There’s no debate. The future is predetermined. The Party is the law. Business assets are confiscated, revalued, funded and redistributed internally to other party members….and the cycle continues. While the rest of the financial world will be gyrating through the roller-coaster-like, downward skewing sine wave, the Chinese Communist Party will be there to scoop up the bargains with all of the US Dollars, Euros, Yen and Sterling they’ve accumulated over decades, slowly migrating the world toward an amalgamation of State Owned Enterprises, political subjugation, and covert systemic control, subject to the whim of the Party. We need only look so far as the China Hustle as an example of this lunacy, to see the world’s financial markets littered with ludicrous, fraudulent Chinese Companies listed on US Exchanges, as a stark reminder of what the Helpers have wrought as our future. Welcome to the new world order dominated by the CPC.

For the love of God….we’ve even made a movie about it!…Now That’s Entertainment!

Blue Horseshoe Loves America!

So how could the US Stock Markets possibly devalue from the roughly $33 Trillion today to my projected $6 Trillion, an 80% decline in just five short years? How will the FED Balance Sheet grow from the paltry $4 Trillion today to a whopping $26 Trillion during the same time period? What’s going to be driving this whipsaw downward spiraling Equity market sine wave? We need to look no farther than the epic 1987 classic Wall Street and simply apply a grander, more globally impressive scale and scope. Like the Chinese Communist Party, we need to think big. We need to broaden our horizons.

I find it particularly ironic that after all of the IP theft, industrial and military espionage, fake financial statements and knock-off retail goods, that the Chinese Communist Party actually copied their master plan to destroy America from a 1987 Charlie Sheen movie. They aren’t even capable of coming up with an original idea for America’s eventual demise…..we even had to come up with that for them.

Today, as I’ve posed for your amusement, if we’re not at the very tipsy-top of the equity cycle, there’s at least a pretty good chance that we’re almost there. If we put it in terms of Wall Street (the movie) we are currently in the “pump” part of the cycle. Chinese influenced buy orders based on all of the market intelligence, guidance and advice of the helpers have been working their way through the system. These buyers aren’t “throwing darts at a board”. They know with certainty that the value of “America” is going up. There is no guess work. The Chinese government is buying. The helpers got the call from Xi’s people and have been letting everyone know that Blue Horseshoe Loves Anacott Steel…..uhhh…..I mean America.

As the helpers buy, the passive “indexers” and algos buy as well. We are on auto pilot….and the markets have gone on, and are still on, an incredible tear. Xi made the call. The helpers spring into action and begin making boatloads of money. Investing is like shooting fish in a barrel when you know exactly what’s going to happen and when. You can comfortably lever up without fear. It’s even more profitable when what you “know is going to happen” is the exact opposite of what everyone else, using their their macro models and historic norms, “thinks should happen”. This is the boom part of the sine wave. Again I’d suggest, and remind everyone, that there’s a good chance that the little 15% downward hiccup back in Q4 2018 was just a trial run for the main event. The Chinese were testing the FED response and training them to follow the plan and use their chainsaw. Of course, the FED passed the test with with flying colors. As the CPC continues to pull dollars out of the Western Financial System, leaving it sit in foreign banks out of reach of the FED and the US Domestic Economy, we see what’s happening today as a preview of what’s about to happen at an even more frenetic pace. The FED will be following the Chinese lead, firing up their chainsaw, buying up assets, implementing TARP-on steroids, increasing their Balance Sheet to $26 Trillion+, perfectly, meticulously according to CPC plan.

Here’s a wonderful video clip (below) that describes what happens when, suddenly, at the peak of the sine wave, the helpers begin to let the street know that… “Blue Horseshoe suddenly no longer loves Blue Star Airlines….uhhh….I mean…..America” and in fact, it will become apparent at some point that “Blue Horseshoe actually Hates America!” and the real selling begins. Some of the early helpers, because of their loyalty to their Chinese Communist handlers, know with certainty that the worm has turned and they get out ahead of the tsunami, put their shorts in place and become wealthier than their wildest dreams would have ever imagined, while those money managers and investors who aren’t quite in the loop struggle to come to grips with it, buying the dip again and again, consequently, eventually getting wiped out. Again, when you know exactly what’s going to happen, with certainty, it’s much easier to make a buck.

Once the FED comes to the rescue, the newly printed dollars which are funding the selling, continue to move off shore into HSBC, Deutsche Bank, Bank of China, ICBC, UBS, Credit Suisse, etc. etc. and every non-US bank branch in the Caymans, Luxembourg, Cypress, the BVI, Bermuda, Hong Kong, Singapore, Switzerland, etc. etc. etc. protecting the anonymous ownership of these US Dollars. Of course, “the non-helpers” caught up in silly metrics like “fundamentals” and “earnings” to determine asset valuations will take a beating. The good, naive folks that run pension funds, mutual finds and blind index funds will be “Gordon Gekko’d”

Per the sine wave model/graphic above (again, no guarantees on timing or scale….that’s up to Xi and company…I don’t have access to the helper’s market intelligence) the downward spiraling sine wave will bottom out in November of 2022 and the Chinese will once again become bullish on America. They will begin bargain hunting in the Spring of 2021 through the end of the year, hit another cycle top the end of 2021 or early 2022 and the selling will again accelerate into 2023….and the sine wave continues on until the US Equity Markets eventually lose roughly 80% of their value by the end of 2024. The FED will walk a fine line between supporting Asset Values and retaining demand for the US Dollar. America’s Main Street Economy will be collateral damage in this battle. The perceived “lost” asset value will have been shifted onto the FED Balance Sheet, presumably locked in Amber for the duration of this financial/economic war forever. Shareholder “equity” will be converted to National Debt.

These price dislocations and resets will continue, impacting the the world’s perception of the dollar as a truly safe store of value, as well as every other dollar denominated asset class (bonds, credit, mortgages, underlying real estate values, etc.) with the end game being, that the Chinese will finally be able to promote the RMB as a viable alternative to the US Dollar as a functioning reserve currency. They will finally allow the world to use the RMB in place of the dollar. They will gradually float their currency, at a favorable exchange rate, over time, locking in the value stolen during this shell-game-daylight robbery. I’d refer to this as a “floating currency with Chinese Characteristics”.

The Villian and the Long List of Accomplices….

So who is the ultimate villain in this “Economic-Whodunit-Thriller-Novella” depicting the destruction of Western Democracy and the American Dream? I’ll give you a hint, the culprit’s name rhymes with “angina” because, to state the obvious, these numbers are giving me a heart attack.

The Chinese Communist Party has lied, cheated and stolen its way though its ascension as the World’s Second Greatest Economy. Whether it be (in no particular order) the trampling of human rights, torture and organ harvesting in Xin Jiang; the fake China Hustle Companies listed on America’s and the World’s stock exchanges; the armies of CPC “investors” somehow showing up in America with steamer trunks full of dollars provided by the Chinese government; the tens of thousands of off shore domiciled ShellCos and bank accounts buying up US Financial Assets and removing dollars from main street America; the isolated unusable, managed bloated RMB; the “trade” of slave labor manufactured goods sold through subsidized fake Amazon/Walmart storefronts in an unquenchable thirst for dollars; the relentless Acela corridor and board room lobbying to create loopholes in America’s financial and legal system, accelerating the recruitment of “helpers”; the continued sponsorship of the synthetic drug trade “by mail” killing tens of thousands of Americans per year (est. to approach 60,000 in 2020….this loss of young life is the equivalent of a Vietnam War every year….but there won’t be a commemorative monument for these unsuspecting soldiers); the continuous, unrelenting theft of global intellectual property, privacy breaches and covert tech/surveillance actors (Huawei, et. al.), etc. etc. etc.

To be clear, the Chinese Communist Party could never have accomplished any of this without the above described helpers. Because these good folks, in charge of making the rules of the game are also the ones taking the money and getting rich, the “helper” class has done quite well. The rest of us “non-Helper” Americans have worked hard, played by the rules and sadly, painfully watched our American dream slowly erode. Many of us think we’ve done something wrong. We just aren’t getting ahead anymore. We work harder for less. Some of us can’t even get (or hold) a descent a job. We can’t afford to pay for college or even a doctor’s bill. Many of us think the world is out to get us and we’re just looking for the kinds of breaks we used to get, or better yet, the opportunities that our parents had. Unfortunately, when we truly examine this, our business and political leadership, in their unrelenting desire to win the game, have ignored the future and focused on on the raping and pillaging of the present. I’ve got mine….you go out and get yours.

The Chinese Communist Party and their highly compensated non-Chinese advocates, supporters and “Helpers” are about to accomplish what two World Wars and the Cold War couldn’t do. They are about to forever destroy the concept of “Democracy by/for/of the people”.

We’ve been “Upton Sinclair-ed…” by our leadership….and only they can change the course of history and America’s destiny.

I hope and pray they have the guts to do it before it’s too late.

That’s All for Today…

There you have it. I hope you’ve enjoyed reading the world’s first “Economic-Whodunit-Thriller-Novella” as much as I’ve enjoyed writing it. My fondest hope is that someone important enough, with at least some decision making authority, be it at the FED, the White House, the Pentagon, FBI, SEC, etc. feels at least some sort of moral, patriotic obligation, and truly takes the time to understand what’s happening, making it their mission (as I have) to do what they can to stop this financial contagion and somehow save democracy and the American dream for my grand children.

To my chagrin, since it’s gotten this far, I fear that my “fondest hope” has become a real long shot.