Just when I think that Alibaba management and their sell-side-analyst, unindicted co-conspirators couldn’t possibly do anything dumber….they go and do something like this…..and totally redeem themselves!

Here are the links:

Press Release:

https://www.alibabagroup.com/en/news/press_pdf/p200522.pdf

Presentation:

https://www.alibabagroup.com/en/ir/presentations/pre200522.pdf

Webcast:

https://edge.media-server.com/mmc/p/w4pv3ort

6-K

https://www.sec.gov/Archives/edgar/data/1577552/000110465920065398/a20-20766_1ex99d1.htm

Call Transcript:

As you all know, I’ve been reviewing Alibaba’s investor calls and filings, just for fun, since they first started this quarterly Dog and Pony show just six short years ago. Time flies.

Every call has been an adventure, to say the least, but I have to say, that this one, was an absolute work of art!….an unrelenting gut-buster, chock full of financial comedy genius….Oh God make it stop!….You’re killin’ me man!…..Bravo!

Daniel, Maggie and Rob never fail to disappoint, and the “analysts” (Binnie Wong – HSBC, Eddie Leung – Bank of America Merrill Lynch, Piyush Mubayi – Goldman Sachs, Alex Yao – JP Morgan, Thomas Chong – Jefferies, Jason Helfstein – Oppenheimer, Gregory Zhao – Barclays, Alicia Yep – Citigroup, Mark Mahaney – RBC).….are absolutely worthy of “best performance in a supporting role” awards or possibly voted “sell-side analyst(s) most likely to get their firm(s) into a shareholder lawsuit”.

First, let me be crystal clear….The above named “analysts”, like the soldier who is handed a flame thrower and told to go out and burn down a village, or the military pilot who is ordered to bomb a town, or the cop who puts his knee on a guys neck for 9 minutes, knowing full well that they could all be causing significant collateral damage to families, kids and the residents of the villages, towns, and communities that they targeted, all justify their actions by thinking “Hey, I’m just doing my job”. In the name of their god and country, the pilot, the soldier and the cop all know that they can’t disobey a direct order, they need to get the job done, and if they don’t a court-marshal, trial, imprisonment or demotion or job loss might soon follow. They find themselves in a situation where there are no good decisions. That said, there’s a good chance that these seemingly nice young “analyst” folks and the many financial “helpers” out there, are in the same boat. They are just following Chinese Communist Party orders, getting paid well to do it, and fear the repercussions to their careers if they don’t. But, unfortunately, they don’t understand, at least today, that when this is all over, there’s a good possibility that their actions will be judged as “financial war crimes”…..unless, of course, the Chinese Communist Party wins the war. They are apparently hoping they picked the right side.

As always, out of respect for your time, the more entertaining, important text is highlighted in RED below.

I’m going to jump ahead to the Q&A section, minute 34:00 of the call, just because it was fully endemic to, and illustrative of, the silliness of this whole proceeding.

The more things change….

First, we note a change in format for this particular call. The questions were asked in either Chinese or English depending on the preference of the questioner. The question was then translated to the “other” language for the benefit of the non bilingual folks on the call, then the answer was given, by either Maggie or Daniel in the preferred language of the questioner, with the answer also translated into the “other” language for the benefit, again, of all of the non-bilingual folks on the call. Again, this was the first time they’ve done a bilingual Q&A, perhaps in anticipation that they’ll no longer need to do the English version as some point in the future.

Now, of course, this makes a lot of sense now that they’ve listed in Hong Kong. As a CEO/CFO you’d always prefer to do just one (1) Dog and Pony (D&P) show when you’re just “makin’ irrelevant shit up”. After all, if you’re doing multiple D&P shows you could end up “makin’ different irrelevant shit up” in different languages, for different classes of investors in different markets on different exchanges and that might be confusing and problematic for everyone. The big down side, for ‘merican speakin’ guys and gals like us, is, of course, that it takes much longer, more than an hour in this particular case, to get through the nine (9) irrelevant multi-lingual, stupid, made-up questions and answers. It’s also a huge distraction to ‘merican investors like us, who don’t understand a lick of what the hell they are actually saying. (I’m, of course, referring the the Chinese language stuff here….not the English language stuff, although it’s equally unintelligible.)

I’ve listed the actual stupid, irrelevant questions that were asked by the analysts (paraphrased and embellished for dramatic effect ) below. Again, these are the actual topics/questions. This, to my shock, is the absolute best, that these titans of finance could come up with. (Remember, we know with certainty, that these people are absolutely financial wizards, anointed as such, by virtue of this plum assignment, by the greatest financial institutions in the world). Note: I won’t even bother to analyze the responses since the answers were equally stupid and irrelevant.

1.) Binnie Wong – HSBC (minute 35:00 – Chinese Question)

“Tell us about your awesome strategy in the lower tier cities again….like you always do….in every quarterly call”

2.) Eddie Leung – BoA/ML (minute 41:00 – Chinese Question)

“Tell us about your long term strategy for live streaming and the incredible value you derive from overpaying Chinese celebrity endorsers…. “

3.) Piyush Mubayi – Goldman Sachs (minute 46:00 – English Question)

“Can you describe your assumptions on forward guidance?…you never miss a target…your awesomeness in incredible!”

4.) Alex Yao – JP Morgan (minute 53:00 – Chinese Question)

“Can you talk about your advertising performance and monetization of recommendations?”

5.) Thomas Chong – Jeffries (minute 1:01 – English Question)

“Can you talk about the post-virus consumer spending power and patterns?”

(I particularly enjoyed the detailed analysis of how ladies cosmetic sales are down because “women don’t wear makeup when they are wearing surgical masks”….cutting edge analysis. 1:07 of the call…..I’m not kidding.)

6.) Jason Helfstein – Oppenheimer (minute 1:08 – English Question)

“Can you talk about the real health of the Chinese consumer? Is it pretty good? …it is, isn’t it?….is there a lot of pent up demand, like, consumers have the ability right now to spend more, they’re just not, because they don’t need the items, consistent to what you talked about, like not needing makeup, if you’re wearing a surgical mask, for example?…..how was that?….was that Ok?…..I’m new here….Oh shit ….was my mic on?”

7.) Gregory Zhao – Barclays (minute 1:15 – Chinese Question)

“Tell me about cloud services again. Even though it’s only a tiny bit of your revenue, I think it’s important that we kill some time on this in both Chinese and ‘merican. We know that internationally players like Microsoft and Google are doing really well… Alibaba and its Chinese competitors seem to be going slower. (I’m not insulting your awesomeness here since you had given me this question to ask…remember?) Can you tell us how it would be possible to make a great leap forward like I know you are capable of?….oh crap, I said ‘great leap’….I didn’t mean ‘great leap’….I know I’m not supposed to say anything about the ‘great leap’…please don’t send me to Xinjiang…”

8.) Alicia Yep – Citi – (minute 1:23 – English Question)

“Could you give us some color on the subsidy measure that you provide to merchants?….you know, you give them subsidies?….and you measure it?…”

9.) Mark Mahaney – RBC (minute 1:30 – English Question)

“What are the biggest structural changes that will occur to your business or to the digital economy because of the COVID-19 crisis?….I understand that the global pandemic has had no impact on your business, but I wanted you to reemphasize how bullet-proof the business really is….”

Well….there you have it…nothing to do with earnings, margins, profitability, balance sheet, “Questionable Asset growth”, other “gains and losses”, Share Based Compensation (SBC), etc, etc. etc.

At least there were no “if you were a tree….what kind of tree would you be?” questions….

The longer this goes on, the tougher it will be for Goldman, JPM, BAC, Citi, Oppenheimer, Jeffries, Barclays, RBC and HSBC to wrangle out of this, the joint press release when Alibaba finally folds it’s tent and goes home, wiping out $500 Billion of US Shareholder Market Cap will be something like:

“Of course we have no liability here, all of us, the joint underwriters and promoters of Alibaba, jointly, severally and accidentally, through no fault of our own accidentally hired the dumbest, most incompetent group of analysts imaginable. There was no systemic wrong doing here! We didn’t collude or do anything like that. We had no idea why those dumb-ass analysts were independently (without any guidance by us whatsoever) asking all of those stupid irrelevant questions….not our problem though….too bad a bunch of equally dumb-ass ‘merican investors lost tons of money in their 401k’s and mutual funds when this mess imploded taking the ‘merican stock market down the shitter with it, further causing JayPo to print another $10 Trillion to ‘save the banks’ again……it’s not our fault Marco Rubio and the US government went nuts and de-listed these fake stocks….blame Marco….the whole thing is a damn shame….”

If I Were An Alibaba Analyst….

If I only had an hour to ask questions in either Chinese or English, knowing full well that I’d be cut off in mid-sentence once I went down any of these paths, here is the list of a few of the questions I might proffer. Of course, if I were one of these brave “analysts”, making the conscious choice to immediately forfeit my employment, at least, if I were one of the English speaking “analysts” on the call who still might want to travel, I’d be thinking that losing my job might be a better option than risking getting picked up by the FBI/INTERPOL whenever I set foot off of mainland China.

Property Plant and Equipment

MY QUESTION: It would be great if you could provide some color on your property plant and equipment growth. You spent US$1.0 56 Billion on PP&E in the Quarter ended and $4.502 Billion for the year ended March 31st, 2020. There’s nothing in your filings about this. As you know we analysts always analyze the growth of Alibaba PP&E in terms of “Burg Khalifa’s built”, so, even though you are an ‘asset-lite’ business, and haven’t made/disclosed any significant acquisitions this year, could you explain how you’ve built the rough equivalent of one (1) Burj Khalifa in the quarter and more than three (3) during the year? Is this just capitalization of kickbacks to political cronies? Are you finally building that “military style data campus” in Heyuan (Guangdong province)?, you know, the one where you are leveling the three mountain tops for no apparent reason?…those types of things should be disclosed in the financial statements….don’t you think?…..anyway….a list of addresses and real estate values would be great since you’ve gone from virtually no PP&E (about $600 million) to having spent $16.711 Billion (roughly 10 Burj Khalifa’s) on Property Plant & Equipment since the IPO (3/31/14).

56 Billion on PP&E in the Quarter ended and $4.502 Billion for the year ended March 31st, 2020. There’s nothing in your filings about this. As you know we analysts always analyze the growth of Alibaba PP&E in terms of “Burg Khalifa’s built”, so, even though you are an ‘asset-lite’ business, and haven’t made/disclosed any significant acquisitions this year, could you explain how you’ve built the rough equivalent of one (1) Burj Khalifa in the quarter and more than three (3) during the year? Is this just capitalization of kickbacks to political cronies? Are you finally building that “military style data campus” in Heyuan (Guangdong province)?, you know, the one where you are leveling the three mountain tops for no apparent reason?…those types of things should be disclosed in the financial statements….don’t you think?…..anyway….a list of addresses and real estate values would be great since you’ve gone from virtually no PP&E (about $600 million) to having spent $16.711 Billion (roughly 10 Burj Khalifa’s) on Property Plant & Equipment since the IPO (3/31/14).

Share Based Compensation (SBC)

MY QUESTION: Could you folks do me a favor and explain why you needed to provide $4.483 Billion (3 Burj Khalifa’s) in Share Based Compensation (SBC) in the current fiscal year and $21.820 Billion (15 Burj Khalifa’s) since the IPO in 2014? This seems like a lot of money to me. Since you only have 117,600 employees right now, if all of the SBC was given to these same employees over the last 6 years, it would amount to $185,544 per employee if the amount was distributed evenly across the board, but it probably wasn’t was it? In the “worlds second biggest economy”, where GDP per ca-pita is a per-pitiful US$10,000 a year, this seems like a really generous use of US Shareholder money…..unless, of course, the SBC is not actually going to your hard working employees, but deployed to Caymans ShellCo accounts controlled by Chinese Communist Party elites to provide instant wealth and stock price support. But then it’s not technically “Share Based Compensation” is it?…. it’s actually “theft of US $21.820 Billion of US Shareholder money”. Please provide a list of “who got the f&#*ing money?”

Interest and Investment Income, net

MY QUESTION: “So…Write ups of “Questionable Assets” this year were $10.303 Billion and a whopping $32.610 Billion since the IPO…..

From my  review of the prior year filings it looks like nearly all of these gains were booked as a result of non-cash, “step acquisitions” and revaluations of the same dog-shit-money-losing businesses (Alibaba Pictures, Alibaba Health, Koubei, Wasu, etc, etc) sold between related parties, at ever increasing valuations. For example, we really don’t know anything about Alipay and Ant Financial, because the financial statements of credit/debit card processors and pay-day “micro-loan” lenders are apparently a closely guarded, Chinese Communist state secret, yet you’ve posted a $10 Billion gain and a corresponding “Asset” based on this hokey exercise of your purchase agreement…and cancellation of a profit sharing and service agreement ..yeah….and all kinds of stuff like that….so what gives?”

review of the prior year filings it looks like nearly all of these gains were booked as a result of non-cash, “step acquisitions” and revaluations of the same dog-shit-money-losing businesses (Alibaba Pictures, Alibaba Health, Koubei, Wasu, etc, etc) sold between related parties, at ever increasing valuations. For example, we really don’t know anything about Alipay and Ant Financial, because the financial statements of credit/debit card processors and pay-day “micro-loan” lenders are apparently a closely guarded, Chinese Communist state secret, yet you’ve posted a $10 Billion gain and a corresponding “Asset” based on this hokey exercise of your purchase agreement…and cancellation of a profit sharing and service agreement ..yeah….and all kinds of stuff like that….so what gives?”

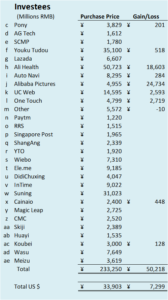

I described a small subset of the “write ups” in the analysis of the “investees” in my blog-post re: the BABA 20-F back in 2018. The chart on the left, republished here, described the “hidden gems” buried in the 2018 20-F. Back then the total value of these assets was $33.903 Billion and the write up gain booked was $7.299 Billion at that time. If you took the time to wade through Footnote 4 (Pg. F-36), which must be read in conjunction with Footnote 11 (Pg. F-71) and Footnote 13 (Pg. F -76), this would give the reader, valuable practice in both turning pages and maintaining concentration as he/she tries to figure out what’s going on. I’ll make every effort to update it again once the 2020 20-F is issued sometime in August or September.

Questionable Assets

MY QUESTION: “So today, Alibaba has $97.262 Billion of “Questionable Assets” sitting on the Balance Sheet, up from about $5 Billion prior to the IPO. I refer to these asset classes (Long Term Investment Securities, Investments in Equity Investees, Intangibles and Goodwill) as “Questionable” because they ONLY have value to Alibaba (i.e. BABA management can’t put a sign out on the front lawn that says “Goodwill and Intangible Assets For Sale” and expect the offers to come flooding in). All of these “Questionable Assets” were created with the help of related and/or ‘friendly’ entities which were more than happy to help the Alibaba Accounting department make liberal use of GAAP/FASB and approved PCAOB valuation and accounting conventions. So can you provide some color on what your real income would have been without all of these fake-gimmicky write-ups? Oh wait, I have it right here, without all of these “investee gains”, write ups and capitalization of what should have been expenses, when we subtract all of these things out, the Balance Sheet drops by about $60 Billion and just like that, Alibaba’s earnings are gone forever….even if we are to believe all of the other silly metrics that you spout (which I don’t), you folks haven’t made a dime and have likely lost money since the IPO….does that sound about right?”

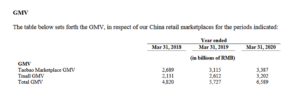

$1 Trillion GMV (sort of)

MY QUESTION: “It really was amazing that you guys, in the middle of a Pandemic, where about a third of the mainland was totally shut down for about half of the quarter, still somehow managed to hit your absurd US$1 Trillion Gross Merchandise Value (GMV) target (…about US$200 Billion more than the Revenue of Amazon and Walmart Combined). It’s even stranger that when you did your last Investor Call on February 13th, 2020, two weeks after the US cancelled all flights from China due to the COVID19 outbreak, when you were sitting in the epicenter of a global pandemic, that none of you, or any of the “analysts”, brought up or mentioned anything about the COVID19 impact on your business, not even once during the call. Not once…. Perhaps, since the GMV number is fake anyway, you felt you didn’t need to discuss the possibility of missing it? I guess it’s really easy to cook the fake books to hit a fake number? Can you provide some color on your thinking here?

Moreover, even though you announce this fake GMV number only once a year now, and have been pretty much guaranteeing, in last year’s investor call and various points throughout the year, that you were going to hit that $1 Trillion target, and even though you knew during the last investor call that in the wacky world of ‘reality’ you’d have a slim chance of doing so, you persevered. You continued to faithfully cook the books. I’m really glad you somehow hit the target, by changing the calculation method and didn’t disappoint all of the dumb-ass gullible US Investors.”

Alibaba’s accounting magic is even more impressive when we take a look at the March 2020 quarter vs the March 2019 Quarter numbers and disclosures.

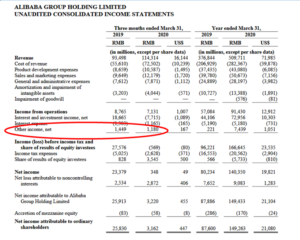

During the quarter, unproven, undocumented, undescribed “revenue” still somehow increased 22% compared to the same quarter in 2019, and unproven, undocumented, undescribed “GMV” increased 23% for the entire year, yet, unfortunately, Net Income declined 99% this quarter, due primarily to a swing from a $2.6 Billion “investment” gain in 2019 vs. a $1.1 Billion loss….or possibly the margins are just lower on “masks” than they are on “make-up”…who knows? (Note: That was a joke…please don’t lecture me on the difference between margin erosion and other income) Tough quarter for profitability, but volume/revenue from unknown, unproven, undefined sources just kept chugging along.

Here’s what Alibaba management said in 2019….

pg. 2 – GMV transacted on our China retail marketplaces was RMB5,727 billion (US$853 billion) for fiscal year 2019, representing a year-over-year growth rate of 19%. Excluding unpaid orders, total physical goods GMV from our China retail marketplaces grew 25% year-over-year, Tmall physical goods GMV increased 31% year-over-year and Taobao physical goods GMV increased 19% year-over-year.

pg. 8 – This results announcement contains translations of certain Renminbi (“RMB”) amounts into U.S. dollars (“US$”) for the convenience of the reader. Unless otherwise stated, all translations of RMB into US$ were made at RMB6.7112 to US$1.00, the exchange rate on March 29, 2019 as set forth in the H.10 statistical release of the Federal Reserve Board. The percentages stated in this announcement are calculated based on the RMB amounts.

Here’s what they said in 2020…. (Management “improvements” are highlighted in red)

pg. 2 – GMV transacted in the Alibaba Digital Economy was RMB7,053 billion (US$1 trillion) for fiscal year 2020, which mainly included China retail marketplaces GMV of RMB6,589 billion (US$945 billion), as well as international retail marketplaces and local consumer services GMV.

pg. 11 – This results announcement contains translations of certain Renminbi (“RMB”) amounts into U.S. dollars (“US$”) and Hong Kong dollars (“HK$”) for the convenience of the reader. Unless otherwise stated, all translations of RMB into US$ were made at RMB7.0808 to US$1.00, the exchange rate on March 31, 2020 as set forth in the H.10 statistical release of the Federal Reserve Board, and all translations of RMB into HK$ were made at RMB0.9137 to HK$1.00, the middle rate on March 31, 2020 as published by The People’s Bank of China. The U.S. dollar amounts of annual GMV for fiscal year 2020 presented in this results announcement represent the sums of GMV in U.S. dollars for the quarters ended June 30, September 30 and December 31, 2019 and March 31, 2020, each converted from the RMB amounts at the average daily exchange rate for each relevant quarter. The percentages stated in this announcement are calculated based on the RMB amounts and there may be minor differences due to rounding.

That said, because they didn’t actually hit the $1 Trillion number, and it would have been totally embarrassing for them, they somehow suddenly “found” RMB464 Billion or US$65 Billion (US$65 Billion…is roughly the annual sales of Lowes) of GMV from brand new sources like “international retail marketplaces and local consumer services GMV”. I have to say, I’ve always enjoyed how brand new, huge revenue and GMV sources, as well as accounting/calculation methods are discovered, changed and pop up for the first time and effectively deployed to goose GMV, Revenue and Earnings, in the year end Investor Call.

The other thing they did was to change the method of exchange rate calculation from the method they’ve used every year since the IPO, “… as set forth in the H.10 statistical release of the Federal Reserve Board” to the hokey “average daily exchange rate” calculation as described on page 11 of the press release and highlighted in red above. In typical Chinese accounting fashion, strange, inconsistent numbers just keep popping up. This change only resulted in an increase of roughly $5 Billion from the old H.10 FRB method, but hey, what’s $5 Billion among friends.

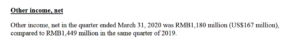

Ant/Alipay Escrow Services

For those of us who are familiar with this travesty and truly enjoy watching this shit-show, we were thinking that now that that hokey “Profit Sharing Agreement” was terminated and management booked that $10 Billion write-up-gain last September, this would be the first “clean” quarter, where we would get to see the actual “escrow fees” paid by Alibaba to Ant Financial for their “escrow services”. For those unfamiliar with the accounting, the accrued “profit sharing” income to Alibaba (from Ant) and the “Escrow Processing” expense to Alibaba (from Ant) were offset in the Income Statement line item “Other Income, net”. In theory, 1/3rd of the massive profitability of Ant would be recorded as Alibaba income, and the offsetting Escrow fees would be recorded as an expense, which magically offset and zeroed out. i.e.) Anyone reading the financial statements could never tell how profitable Ant Financial was, nor could they tell how much Alibaba was paying Ant in escrow services since the amount was recorded as “net”.

Since Alibaba management booked a $10 Billion gain for 1/3rd of the business we can assume that the value of Ant is at least $30 Billion, plus any carrying value that they might have had buried on the balance sheet (which they’ve never disclosed), even though they’ve issued press releases that they believe the Ant/Alipay business to be worth more than $150 Billion.

So, for fun, let’s just pick a “conservative” number, let’s say Ant/Alipay is worth $100 Billion…since we have no idea and they’ve never provided any financial information to anyone. Let’s also say, to get to that number, Ant has a P/E of 15. Therefore, we might expect to see US$550 million of profit sharing “Income” hit the P&L in the current March Quarter if the “Profit sharing agreement” was still in force. ($100B/15/4 quarters/x 33%). In the March 2019 quarter we would have expected to see “Escrow fees” of roughly the same amount, zeroing out the “net” account. Whoa…Wait…Whut?….Here’s the description of what happened in the March 2020 quarter re: “Other Income, net”.

So, there was really no disclosure of the Escrow/Processing fees paid to Ant Financial during the quarter. At least I can’t find them….and it should have been a big number. Since the above estimated $550 million “Profit Sharing” is no longer being accrued, we would have expected to see the “Other Income, net” much lower ($550 million less) than that of a year ago. But it’s not. We know with certainty that the “Profit Sharing” accrual stopped. Did they stop paying escrow fees or transaction fees too? is Ant working for free? Here’s the P&L.

So there’s really no change in the “net” line item even though all of the “Income”, by definition must have been removed from the calculation.

I guess I’d close my question with:

“So…are these financial statements real?….or are they just one gigantic, flaming pile of silliness”

Wake up Maggie …I think I Got Sumthin’ To Say To Wu….

At minute 30:00 of the call, Maggie Wu, Alibaba’s CFO felt compelled to get involved in US politics and address the Holding Foreign Companies Accountable Act which just passed the Senate. I talked about the toothless genesis of this bill a few months ago in my post “How an Ineffective Bill Becomes an Ineffective Law” Again, this bill, for a number of reasons, isn’t a “hammer”, it’s a “permission slip”, designed to provide cover and insulate the Chinese Communist Party “helpers” from legal liability.

Based on Maggie’s composure and demeanor she is the perfect “Angel of Death” delivery vehicle for the type of message the Chinese Communist Party wants to send America. She’s a friendly, nice, demure, pleasant, unassuming, trust-me, sort of a “Mother Theresa” schoolmarm with at least some knowledge of accounting, finance and GAAP. She’s the “sweet little old lady on a motorized cart…”

As we all know, the best fraudsters are the ones you never suspect. It’s easy to believe in someone who demurely talks about the importance of trust, integrity, transparency and openness, as she coyly blathers on about technical, confusing, intelligent, impressive sounding metrics that are all a bizarro-world fairy tale. Alibaba shareholders, because of Maggie’s sweet, schoolgirl demeanor and the unwavering almost religious support from her groupie “analysts”, have been lulled into a blissful euphoria where they “won’t even see it coming!..”.

Here’s what she said…The text in RED below is what I might consider absurd, silly, goofy and not even close to relevant. (Note the Seeking Alpha translation came across as “Peekaboo” for the Public Company Accounting Oversight Board, or PCAOB…it looks silly…but no sillier than the rest of what was said)

So I would like to talk about our outlook, but before that I want to address the recent bill passed by U.S. Senate Holding Foreign Companies Accountable Act. The proposed legislation would essentially prohibit a foreign issuer from being listed on U.S. Stock Exchange, if the U.S. Public Company Accounting Oversight Board, this is our Peekaboo, is unabled to inspect all the work papers of the issuers auditors for three consecutive years due to certain reasons. We will closely monitor the development of this bill and I think it’s important for investors to understand Alibaba’s practice and issues raised under this proposed legislation. First, there is an existing framework of the Peekaboo conduct — of the Peekaboo and for its conduct, an inspection of audit companies with Chinese operations. In this regard, we understand that there has been ongoing dialogs among the big four accounting firms China’s securities regulator DSRC SEC and Peekaboo. With respect to the types of information that are permitted to be exchanged to issuers with Chinese operations while maintaining compliance with Chinese law.

Number two, Alibaba’s financial statements are prepared in accordance with U.S. GAAP and since our inception in 1999, we have been audited by PWC Hong Kong, PWC Hong Kong is the local affiliate of the worldwide PWC’s firm and its auditing standards are overseen by the PWC national office in the United States. The integrity of Alibaba’s financial statements speaks for itself. We have been an SEC filer since 2014 and hold ourselves to the high standards of transparency. Each year we have received and qualified by the opinion our financial statements from PWC.

Third, trust is one of our core values and transparency and integrity are essential components of building trust with all of our stakeholders. All these years we have consistently aimed to grow the business for long-term, maintain compliance with all applicable laws and delivered value for our customers, employees and investors. Investors who bought our stock in 2014 IPO have tripled their investment over the past five and half years.

Given the above, we will endeavor to comply with any legislation whose aim is to protect and bring transparency to investors who buy securities of U.S. stock exchanges. Looking ahead despite a challenging quarter due to pandemic, we achieved our guidance of over $500 billion in revenue and delivered healthy, sustainable profit growth in fiscal year 2020. The reason we have been able to deliver these results is that we sow seeds years ago by investing in technology, in innovation, and in businesses that required far sight and long-term patients. Today the Alibaba digital economy remains strong and growing.

Looking ahead, we will continue the same strategy of delivering robust revenue growth and sustainable profit growth. Although, it is difficult to predict the uncertainty of global economic and geopolitical developments. Based on our current view of Chinese domestic consumption and enterprise digitization, we expect to generate over RMB650 billion in total revenue in fiscal year 2021. We believe our commitment to invest and deepen our value proposition to customers, thereby ensuring robust revenue and profit growth.

Keep in mind that this politically directed, “trust me….you won’t get pregnant” rhetoric was left unquestioned by the co-conspirator “Analysts”. They all followed the script and drank the Kool-Aid with an almost cult-like zeal. By virtue of their inane, softball questions and cult-ish adoration of “all that is Alibaba”, Binnie, Eddie, Piyush, Alex, Thomas, Jason, Gregory, Alicia and Mark are setting themselves up for quite a tumble and either some litigation and possible jail time in America, or maybe one of those sweet jobs at the Bank of China and and the highly coveted “CPC medals of no-freedom” presented directly by Xi himself.

If you have a moment, please take the time to take a peak at one of my favorite series of video clips below. (9 short Ken Lay/Enron clips, about an hour and a half) It illustrates the process, justification and “look the other way” attitude that the “analysts” (Binnie, Eddie, Piyush, etc.) must have developed in order to justify their loyal, zealous and likely illegal, support of Alibaba management’s righteous cause and financial shenanigans.

Re: Enron…you can almost feel the adoration and loyalty that all of these soon to be, unemployed, near bankrupt people showed for their late, great fearless leader, Ken Lay, during the final company meeting just prior to the Enron bankruptcy filing. Listen to the enthusiasm and team-like togetherness rippling through the crowd as they hang on every syllable of his motivational, hope-filled misrepresentation laden bullshit. The meeting ends with an enthusiastic standing ovation for the man who will eventually have been responsible for ruining most of their lives.

So why am I bringing up Enron in the context of the Alibaba Earnings call? Because there must be consequences stemming from Alibaba at some point in time. There must be jail time and significant financial penalties for those who blindly support, validate and endorse the Enron’s, Worldcom’s, Theranos’s, LTCM’s, Maddoff’s, Boesky’s, MF Global’s, Milken’s, Tyco’s, Quest’s, etc. etc. of the world. We’ve not demanded our pound of flesh nearly enough in the in the past….if we did, this silliness would stop. We continue to go through these “cycles that nobody could have possibly seen coming” and pass legislation providing legal cover, so the same bankers and promoters responsible for the last “cycle” can come up with something new, and do it all over again in the next “cycle”. We’ve given Banks, analysts, promoters, accountants and lawyers a free pass for far too long. If we don’t do something visciously meaningful to them, the Bankers, analysts and promoters involved in this impending disaster, once it goes sideways, causing some real damages to deal with, will, as always, all walk away rich.

Of course, as always, the class action lawyers will likely step in, doing their best to dismember the rotting corpse of Alibaba, taking whatever they can get for their clients, although it won’t be much because of the “asset-lite” shielding of the VIE structure. But, hopefully, because this is indeed so egregious, it will be different this time, as long as America’s “bought and paid for” judiciary doesn’t also come to the rescue. The class actions will come rolling in and the judgments will hopefully, devour Goldman, JPM, BAC, Citi, Oppenheimer, Jeffries, Barclays, RBC, HSBC and the others through a swarm of shareholder litigation and piranha-like vigor and precision. After a fair trial, Binnie, Eddie, Piyush, Alex, Thomas, Jason, Gregory, Alicia and Mark will all be forced to rat on their supervisors and bosses to avoid serious jail time, and this time: 1.) The lawyers, courts and regulators will follow the chain of evidence all the way to the C-suites. Senior management will finally do some serious prison time, or: 2.) The analysts will fall on their swords and take those sweet Bank of China jobs on the mainland, out of the reach of US Authorities. I’m thinking, if I were in their shoes, the Bank of China job and a medal from Xi might just be the easy way out. In either case….good riddance.

History doesn’t repeat..it…umm..Oh hell….yes it does….

As you know, this isn’t the first time that Capitalism has produced some wacky results…you know…like the kind of results where titans of industry sold out democracy, and America, to make a few bucks on the side. Using the legal system, their titan-of-industry-political-clout and carefully crafted public relations campaigns, these celebrity Chieftains are always able to make boatloads of money from supporting despotic regimes, and are consequently, “accidentally” bent on destroying democracy and the American Dream which you and I hold so dear. They fly under the radar for years or even decades, covertly working against America, simply because foreign despots usually pay well above market rate for their products and services.

Years ago, it was Ford, GM and the Swiss Banks. Today it’s the Big US Banks, Amazon, Walmart, Tesla, Softbank, Apple and Social Media. Years ago, unfortunately, globalists fervently supported and did everything they could to expedite the post WWI German recovery. At the time, what was good for Germany was good for the world. America was opening new markets and helping the German people. The Nazi’s seemed so nice at the time. As they say, “Good people!” Today, and for the last few decades our new generation of globalists has been placing their emphasis on the many potential benefits (mostly inuring to them) of bringing the Chinese Communist party into the global community, continually hoping beyond all hope, that the Chinese leadership would somehow suddenly become enlightened, embrace the benefits of Western Democracy and adopt a market driven economy and an open society.

This time, if we get through this, we’ll need to make some serious changes in how we administer this crazy government “of, by and for” the people. I’ve attached a link to a wonderful “oldie but goody”(November 1998) piece from the Washington Post immediately below….

“Ford and GM Scrutinized for Alleged Nazi Collaboration“

It’s a wonderful, well written article describing the saga of the pre-WWII US Auto Makers, their quest to expand globally and their close personal relationship with the Nazi Party. I hope you take the time to read it in its entirety. Apparently, as Germany’s economy recovered, and our auto makers were looking for new, profitable sales channels, they were willing to ignore a few of the darker aspects of Nazi-ism in order to “get the order” so to speak. Ford and GM, as well as the Swiss Banks had become the biggest providers of foreign capital, technology and expertise to the Nazi party and primary enablers of Hitler’s Third Reich. Of course, their profits soared. Here are a couple of paragraphs from the article which sums up the close, personal relationship Henry Ford had with good old ‘dolf.

“When you think of Ford, you think of baseball and apple pie,” said Miriam Kleinman, a researcher with the Washington law firm of Cohen, Millstein and Hausfeld, who spent weeks examining records at the National Archives in an attempt to build a slave labor case against the Dearborn-based company. “You don’t think of Hitler having a portrait of Henry Ford on his office wall in Munich.”

Both Ford and General Motors declined requests for access to their wartime archives. Ford spokesman John Spellich defended the company’s decision to maintain business ties with Nazi Germany on the grounds that the U.S. government continued to have diplomatic relations with Berlin up until the Japanese attack on Pearl Harbor in December 1941. GM spokesman John F. Mueller said that General Motors lost day-to-day control over its German plants in September 1939 and “did not assist the Nazis in any way during World War II.”

The photo to the left is that of German diplomats awarding Henry Ford, center, with their nation’s highest decoration for foreigners, the Grand Cross of the German Eagle, in July 1938. (AP Photo)

The Nazi Party, it would seem, really took a shine to Henry Ford and his business, GM and the Swiss Banks, probably since they were all willing to look the other way as the Germans built their war machine and death camps.

Note that this information was only unearthed and made available to the media long after the fact. This article, written more than 50 years after these archives were discovered, describes what should have been obvious to anyone looking at the situation objectively….Hey, why is Henry making all of those trips the Germany? Why does he have Hitler’s address and phone number in his Rolodex? Why are there so many Opel’s on the streets of Berlin? How come Swiss Bankers are always showing up at the Reichstag? Where is all of this new Ford and GM revenue and profit really coming from? Investigators, bankers, stock analysts, regulators and anyone who should have been able to see and understand what was going on, chose to look the other way in the name of profit, afraid and likely intimidated enough to ignore the obvious.

Fast forward to today and what do we have? Were Ford, GM and the Swiss Banks materially impacted by their involvement with the Nazi party? Were there any adverse repercussions as a result of their actions and their support of the most despotic, evil regime in the history of humankind? The short answer, is no. They continued on, business as usual. Ford/GM, Mom & Apple Pie. Money and political clout buy a lot of silence in America. They always have. It did so then and even more so now. American business leaders tend to prove, in an ever increasing fashion, that you can pay the world to look the other way if you have enough money and you give it to the right people.

That’s exactly what’s happening today, on the Alibaba Investor Call, and the hundreds of thousands of smaller/similar calls, investments, transactions and deals going on around the world on a daily basis.

This time, things must be different. We must take a different path. Democracy, and Western survival depends on it. This time, even though the bag holding investors, at the time of the eventual implosion, will never see a dime from their investments coming back from China, no matter how hopeful their lawyers might be, the real targets for shareholder vengeance must be the “helpers”. In the end, any business or person who participated in this Chinese Communist subterfuge must pay an immediate, significant price. I’m talking about some fire and brimstone, good old fashioned “Old Testament” revenge here. I’m talking about significant vengeance, jail time for any of the helpers, Binnie, Eddie, Piyush, Alex, Thomas, Jason, Gregory, Alicia and Mark, once they receive a fair trial by a jury of their peers in a very public US Federal Courtroom, if convicted, they should all looking at significant jail time unless they spill their guts on who told them what to say and how to say it, followed by significant, but far from complete “forgiveness” to those executives who cooperate, as we work our way up the chain of evidence, until we get to where the buck actually stops…..and today’s version(s) of Henry Ford must be hung out to dry, and locked up for a good long time.

That said, we’ve been far to lenient, as is evidenced by the latest silly volley of “stop China’s financial fraud” legislation, giving the CPC three years to comply with US Laws. Absurd. America will be in flames by then….the fires are starting as I type.

Without serious, systemic change, we will continue to let the getaway car drivers get off Scott-free since they apparently don’t understand that failing to ask questions of the hooded gunmen sitting the back seat of the getaway car is “aiding and abetting”, while the real criminals are insulated from prosecution and penalty by the inherent design of our legal and financial systems. We need to redefine our securities laws focused on the professional responsibility of these “analysts” and their role in these schemes, rather than protect them through pathetic legislation. “Feigned, framed as unintentional, criminal stupidity” should no longer be treated as an “Oh my God!…how could we possibly have seen this coming?” error. It must be redefined to at least a first degree felony, the equivalent of a financial murder, rape or kidnapping, because that’s exactly what this is. Until we take this step, and assign real responsibility and criminal liability, these “cycles” won’t stop. Until we take action and pass meaningful, real, laws, and enforce them with a vengeance, that will put the fear of god in these “analysts”, the “little guy” in America can continue to expect to be wiped out in cyclical waves, on a periodic basis, until there’s no America left.

Moreover, I’m also talking about eliminating the never ending parade of “slap on the wrist” penalties for these “organizations”, Goldman, JPM, BAC, Citi, Oppenheimer, Jeffries, Barclays, RBC, HSBC and the others. I’m talking about potential death penalty sanctions, liberal use of RICO, firing the management, lifetime industry bans, closing them down, seizing their assets and transferring the assets to the highest, non-corrupt, qualified bidder. Hell, most of these businesses are just a pile of shitty, overpriced assets that they are just trying to bundle up and sell to their respective Central Banks anyway. Let’s make it easy on them and finish the job.

We’d be putting them out of their misery and life would go on.

That, my friends, is how a real market driven economy is supposed to work.

Have a nice day…..